Udyam Flex Loan: Your New Business Partner

This is the age for new startups and you can scale your idea into a full-fledged business more conveniently than ever. But how did we reach this convenience? The answer is just one- The conducive environment for businesses to bloom. Economic development, market availability, access to sources and resources, and Business loans are a few major attributes which are making the environment conducive. If you are also a business owner with great ideas for expansion and growth, choosing the Udyam Flex Loan can be the best financial shot you take. This innovative loan option is tailored to meet the unique needs of entrepreneurs and small business owners, providing the financial boost necessary to turn ambitious plans into reality.

Udyam Flex Loan: Business ka Booster

This loan is more than just a financial help; it’s a powerful support system that can help propel your business to new heights. Whether you’re looking to expand your operations, invest in new equipment, or simply need working capital to manage cash flow, this loan is designed to be your reliable business partner.

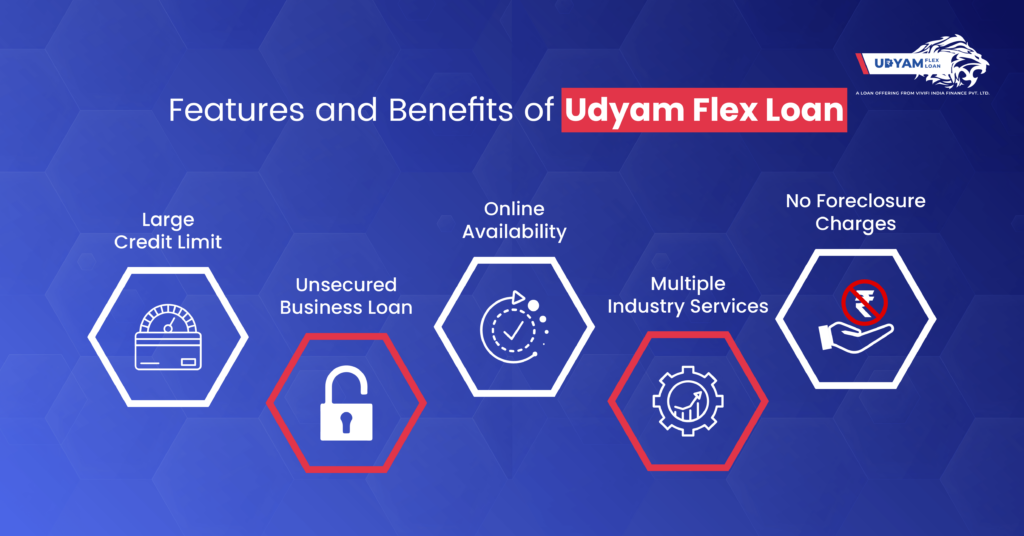

Features and Benefits of This New Business Loan

- Large Credit Limit: One of the standout features of the Udyam Flex Loan is its generous credit limit. Unlike traditional loans that may restrict your borrowing capacity, this loan provides ample financial resources to fuel your business ambitions. You can borrow a credit of up to Rs. 10 Lacs with this loan. It ensures the necessary funds for substantial projects or investments for your business without the need for multiple loan applications.

- Unsecured Business Loan: In a departure from conventional business loans, this new small business loan is unsecured. It means you don’t need to pledge any collateral to access the funds. This feature is particularly beneficial for new businesses or startups that may not have significant assets to offer as security. By removing this barrier, the loan becomes more accessible to a wider range of entrepreneurs.

- Online Availability: In our digital age, convenience is key. The Udyam Flex Loan embraces this principle by offering a fully online application process. From initial inquiry to final approval, you can manage everything from the comfort of your office or home. This digital-first approach not only saves time but also reduces the paperwork burden typically associated with loan applications.

- No Foreclosure Charges: Flexibility is at the heart of the Udyam Flex Loan, and this extends to loan repayment as well. If your business performs better than expected and you wish to repay the loan early, you can do so without incurring any foreclosure charges. This feature allows you to manage your finances more efficiently, saving on interest payments.

- Multiple Industry Services: Recognizing that different industries have unique financial needs, the Udyam Flex Loan is designed to cater to a wide range of sectors. Whether you’re in manufacturing, services, retail, or any other industry, this loan can be tailored to suit your specific requirements. This versatility makes it an ideal choice for businesses across various sectors.

Types of New Business Small Loan We Offer

- Working Capital Loan: Managing day-to-day operations and maintaining a healthy cash flow are critical for any business. The Working Capital Loan under the Udyam Flex Loan program provides the financial cushion needed to cover operational expenses, inventory purchases, or short-term obligations. This ensures that your business can operate smoothly even during lean periods or seasonal fluctuations.

- Equipment Financing: For businesses looking to upgrade their technology or machinery, the Equipment Financing option is invaluable. This loan type allows you to invest in state-of-the-art equipment without straining your cash reserves. By facilitating these crucial investments, the loan helps improve your operational efficiency and competitiveness in the market.

- Growth Capital: When opportunity knocks, you need to be ready to answer. The Growth Capital loan is designed for businesses poised for expansion. Whether you’re planning to open a new location, launch a new product line, or enter new markets, this loan provides the financial backing to support your growth initiatives. It’s an investment in your business’s future, helping you scale up and reach new heights.

Eligibility Measures to Apply for The Udyam Flex Loan

-

- Operational History: To qualify for the loan, your business should have a minimum operational history of 6 months or more. This requirement helps us to assess the stability and viability of your business. While the exact duration may vary, a track record of at least six months to a year is expected.

- MSME Registration: As the name suggests, the Udyam Flex Loan is targeted at Micro, Small, and Medium Enterprises (MSMEs). To be eligible, your business should be registered under the MSME category. This registration not only qualifies your business for this loan but also opens doors to various other government schemes and benefits.

- Minimum Turnover: To ensure that businesses can comfortably manage loan repayments, a minimum annual turnover criterion is typically in place. This threshold may vary based on the loan amount and type but serves as an indicator of your business’s financial health and repayment capacity. Generally, a business with a turnover of 30,000/m can qualify for this loan.

Application Process- Udyam Flex Loan

Step 1: Fill Personal & Business Details

-

-

- Enter personal details

- Enter business & registration details

- Enter loan request details

-

Step 2: Upload Documents

-

-

- Provide identity proof

- Provide bank statements & business documents

- Complete the verification

-

Step 3: Loan Approval!

-

-

- Access funds instantly to scale your business

-

The Udyam Flex Loan represents a significant step forward in business financing. By offering flexible terms, easy accessibility, and a range of loan types, it addresses the diverse needs of modern businesses. Whether you’re a budding entrepreneur or an established small business owner looking to expand, this loan can be your financial partner to achieve your business goals. Remember, in the world of business, having the right financial support can make all the difference. With the Udyam Flex Loan, you’re not just getting a loan; you’re gaining a partner invested in your success.