Udyam Flex Loan vs. Traditional Bank Loans

Traditional Bank Loans, offered primarily by banks and credit unions, have long been the standard for businesses seeking capital. These loans involve a rigorous application process, and extensive documentation, and often require collateral. In contrast, our Business Loan provides a more flexible and accessible alternative. These leverage technology and alternative data sources to streamline the application process and offer quicker approval.

Traditional Business Loan

Traditional Bank Loans are credit offered by established banking institutions and credit unions. These loans provide capital to businesses for various purposes such as expansion, equipment purchase, or working capital. They can offer a larger loan sum to qualified borrowers at a competitive rate of interest. However, they include a rigorous application process, extensive documentation, collateral and strict credit score requirements. These loans often involve longer processing and approval times, less flexible repayment options, and lower approval rates. For new or unconventional businesses, the process may also require in-person meetings, which can be time-consuming for busy entrepreneurs.

Udyam Flex Loan

It is a new-age MSME Business Loan with easy eligibility criteria and a fast credit access facility. This Business Loan is the Business ka Booster that can meet all the financial needs a business might have. This provides the working capital boost, equipment financing and growth capital to a business for its development and expansion. This flex credit comes with a rapid approval feature.

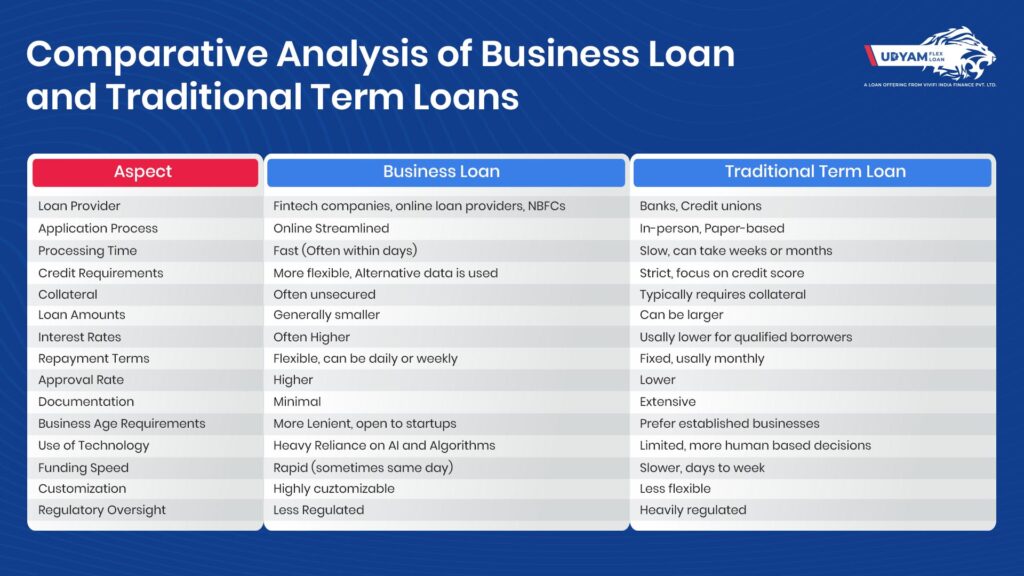

Comparative Analysis of Business Loan and Traditional Term Loans

| Aspect | Business Loan | Traditional Term Loans |

| Loan Provider | Fintech companies, online loan providers, NBFCs | Banks, credit unions |

| Application Process | Online, streamlined | In-person, paper-based |

| Processing Time | Fast (often within days) | Slow (can take weeks or months) |

| Credit Requirements | More flexible, alternative data is used | Strict, focus on credit score |

| Collateral | Often unsecured | Typically requires collateral |

| Loan Amounts | Generally smaller | Can be larger |

| Interest Rates | Often higher | Usually lower for qualified borrowers |

| Repayment Terms | Flexible, can be daily or weekly | Fixed, usually monthly |

| Approval Rate | Higher | Lower |

| Documentation | Minimal | Extensive |

| Business Age Requirements | More lenient, open to startups | Prefer established businesses |

| Use of Technology | Heavy reliance on AI and algorithms | Limited, more human-based decisions |

| Funding Speed | Rapid (sometimes same-day) | Slower (days to weeks) |

| Customization | Highly customizable | Less flexible |

| Regulatory Oversight | Less regulated | Heavily regulated |

Traditional loans often cater to established businesses with strong credit histories. While Business Loans are more accommodating to startups and businesses with less conventional financial profiles. The repayment terms and structure also differ, with a Business Loan frequently offering more customisable options. As businesses navigate their financing needs, the Udyam Flex Loan can be a more suitable choice for your business.

Reasons That Make This Business Loan The Best

- You can get a loan of up to Rs. 10L.

- It needs no collateral for approval.

- Get this loan with a credit score of 500+.

- It has a 100% digital application process.

- Prepay the loan with zero foreclosure charges.

Eligibility Criteria for Udyam Flex Loan

- Businesses with an operational history of above 6 months

- Businesses with a minimum turnover of INR 30,000/m

- Businesses with MSME/Udyam Registration or GSTIN number

Process For Udyam Flex Loan to Apply Online

Step 1: Fill Personal & Business Details

- Enter personal details

- Enter business & registration details

- Enter loan request details

Step 2: Upload Documents

- Provide identity proof

- Provide bank statements & business documents

- Complete the verification

Step 3:

- Loan Approval!

- Access funds instantly to scale your business

The Udyam Flex Loan offers significant advantages over traditional term loans for Businesses. It makes a more attractive option for modern entrepreneurs. Unlike a traditional Bank Loan with rigid terms, this loan provides greater flexibility in repayment schedules. It is allowing businesses to align payments with their cash flow cycles. Its streamlined application process and minimal documentation requirements reduce the time and effort needed to get funding. The loan’s approval criteria are more inclusive, considering factors beyond just credit scores. It can open doors for startups and businesses with limited credit history to grow faster.

The Udyam Flex Loan also offers customizable loan amounts and terms, catering to specific business needs rather than forcing a one-size-fits-all approach. This combination of flexibility, speed, and accessibility makes the Udyam Flex Loan a superior choice for businesses seeking agile financial solutions.