Types of Businesses in the MSME Sector

Have you ever wondered what powers India’s dynamic economy? Micro, Small, and Medium Enterprises (MSMEs) are pivotal, contributing around 30% to the GDP and employing over 110 million people. These enterprises span various industries, from manufacturing to services, significantly influencing industrial output and exports. In this blog, we will explore the types of businesses within the MSME sector and discuss how the Udyam Flex Loan can help these businesses secure an MSME business loan and grow. We’ll also cover how to get an MSME business loan, making it easier for you to fuel your entrepreneurial dreams.

What is an MSME?

MSME stands for Micro, Small, and Medium Enterprises. These enterprises occupy crucial roles in the economy, particularly in the production and processing of goods. Typically, MSMEs operate on a smaller scale compared to large corporations.

MSMEs contribute significantly to local development by fostering innovation and adaptability. They span various sectors, including small bakeries, local workshops, and emerging online businesses. Consequently, MSMEs are often seen as the backbone of many communities due to their essential role in economic growth and community support.

How is the MSME Sector Classified?

The MSME sector encompasses a wide array of businesses categorized based on their investment in plant and machinery or equipment. These enterprises are classified into micro, small, and medium categories, each defined by specific investment thresholds. Here’s a breakdown of these categories based on the latest criteria set by the Government of India:

| MSME Category | Investment in Plant and Machinery |

| Micro Enterprises | Up to ₹1 crore |

| Small Enterprises | ₹1 crore to ₹10 crores |

| Medium Enterprises | ₹10 crores to ₹50 crores |

Types of Businesses in the MSME Sector

The Micro, Small, and Medium Enterprises (MSME) sector is a diverse and dynamic part of the economy, encompassing a wide range of industries and business types. MSMEs play a crucial role in economic development, providing employment, fostering innovation, and contributing significantly to GDP. Here’s an in-depth look at the various types of businesses that fall under the MSME sector:

- Manufacturing Enterprises

- Textiles and Garments: Production of fabrics, clothing, and textile products.

- Food Processing: Processing raw food materials into packaged foods and beverages.

- Leather Products: Manufacturing footwear, bags, and accessories.

- Pharmaceuticals: Producing medicines and healthcare products.

- Electronics and Electrical Equipment: Making electronic gadgets, appliances, and components.

- Automobile Components: Manufacturing parts and accessories for the automotive industry.

- Plastics and Rubber Products: Production of plastic and rubber items.

- Service Sector Enterprises

- IT and Software Services: Software development, IT consulting, and IT-enabled services.

- Healthcare Services: Hospitals, clinics, diagnostic centers, and healthcare providers.

- Educational Services: Schools, coaching centers, and online education platforms.

- Tourism and Hospitality: Hotels, travel agencies, and tour operators.

- Logistics and Transportation: Transportation, warehousing, and logistics services.

- Professional Services: Legal, accounting, consulting, and other professional services.

- Repair and Maintenance Services: Repairing electronics, appliances, and vehicles.

- Retail and Trade

- Grocery Stores: Local shops selling food and household items.

- Clothing and Accessories Shops: Retailers offering apparel, footwear, and accessories.

- Electronic Goods Retailers: Stores selling electronics, smartphones, computers, and appliances.

- Bookstores: Retailers specializing in books, stationery, and educational materials.

- Online Retail Businesses: E-commerce platforms selling a wide range of products directly to consumers.

- Agriculture and Allied Activities

- Organic Farming: Cultivating crops using organic methods.

- Dairy Farming: Raising cattle for milk production and dairy products.

- Poultry Farming: Raising chickens for meat and eggs.

- Horticulture: Growing fruits, vegetables, flowers, and ornamental plants.

- Aquaculture: Breeding and raising fish and aquatic organisms.

- Agri-Tech Services: Providing technological solutions to enhance agricultural productivity.

- Construction and Real Estate

- Small-Scale Construction Firms: Building residential, commercial, and industrial projects.

- Interior Design Services: Providing design and decoration services for homes and offices.

- Real Estate Brokerage: Assisting in buying, selling, and renting properties.

- Handicrafts and Artisanal Products

- Handloom Textiles: Weaving fabrics using traditional methods.

- Pottery and Ceramics: Crafting pottery and ceramic items.

- Jewelry Making: Creating handcrafted jewelry pieces.

- Woodworking and Furniture Making: Producing wooden furniture and decorative items.

- Renewable Energy

- Solar Panel Installation Services: Installing solar panels for residential and commercial use.

- Wind Energy Solutions: Providing wind energy technologies and services.

- Biomass Energy Production: Converting organic materials into energy.

- Waste Management and Recycling

- E-Waste Recycling: Recycling electronic waste to recover valuable materials.

- Plastic Recycling Units: Processing plastic waste into reusable materials.

- Waste Collection and Segregation Services: Collecting and segregating waste for proper disposal and recycling.

- Beauty and Wellness

- Salons and Spas: Offering beauty treatments and wellness services.

- Fitness Centers and Gyms: Providing exercise and fitness facilities.

- Ayurvedic and Herbal Product Manufacturing: Producing natural and herbal health products.

- Entertainment and Media

- Content Creation Services: Producing digital content for various platforms.

- Small-Scale Film and Video Production: Creating films and videos for entertainment and marketing.

- Digital Marketing Agencies: Providing online marketing services to businesses.

Importance of MSMEs and Access to Business Loans

MSMEs are pivotal to economic growth, contributing significantly to employment generation, industrial output, and exports. These enterprises often face challenges in accessing adequate financing to expand operations, upgrade technology, and enter new markets. MSME business loans play a crucial role in addressing these challenges by providing financial support tailored to the specific needs of small and medium enterprises.

How to Get MSME Business Loans

Securing an MSME business loan involves a few key steps that align with the requirements of lenders and regulatory guidelines. Here’s a streamlined process to help you obtain the funding you need:

- Prepare Your Business Plan and Documents: Develop a detailed business plan that includes your business model, market analysis, financial projections, and funding needs. Gather all necessary documents such as your business registration proof, financial statements, tax returns, and KYC documents.

- Select the Right Lender: Research various MSME loan options from banks, non-banking financial companies (NBFCs), and government schemes. Look for reputable lenders like Udyam Flex Loan from Vivifi India.

- Complete the Loan Application: Fill out the loan application form provided by your chosen lender, ensuring you submit all required documents. Depending on the loan amount and terms, some lenders might request additional information or collateral.

- Get Loan Approval and Funds Disbursement: After your application and documents are reviewed, the lender will approve the loan if everything meets their criteria. The approved funds will be disbursed in your business account. Make sure you comply with all regulatory requirements and loan conditions.

- Repay the Loan: Follow the agreed repayment schedule, making timely payments to maintain a positive credit history and avoid any penalties. Consistent repayment can also improve your chances of securing future loans.

By following these steps, you can successfully navigate the process of obtaining an MSME business loan, ensuring your business has the necessary funding to grow and thrive.

Udyam Flex Loan: Empowering MSME Entrepreneurs

Udyam Flex Loan, offered by Vivifi India Finance Pvt. Ltd is tailored to empower MSME entrepreneurs across various sectors. Industries including manufacturing, services, retail, construction, and healthcare can significantly benefit from this financial support. These loans offer a hassle-free way to access up to ₹10 lakhs, with interest rates ranging from 18% to 48% and tenures between 6 to 18 months. The benefits of Udyam Flex Loan include:

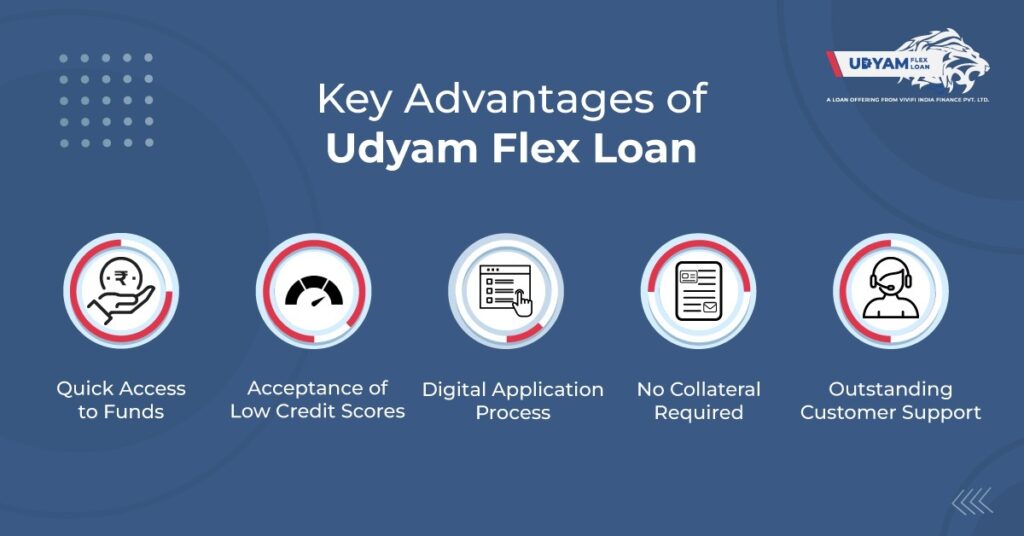

Key Benefits of Udyam Flex Loan

- Easy Access to Funds: Obtain loans of up to ₹10 lakhs without the complex procedures typical of traditional loans.

- Low Credit Score Accepted: Even with a credit score of 500+, you can qualify for a loan, making it accessible to a wider range of shop owners.

- Fully Digital Application: The application process is entirely online, ensuring speed and convenience.

- No Collateral Needed: No collateral is required, reducing the risk for borrowers.

- Excellent Customer Support: Udyam Flex Loan provides outstanding customer service to assist you throughout the loan process.

Eligibility Criteria For This MSME Loan

- Minimum Business Operational History: 6 months

- Business Registration Proof

- Minimum Monthly Turnover: ₹30,000

How to Apply for Udyam Flex Loan

Applying for a Udyam Flex Loan is straightforward and can be done in three simple steps:

- Download the App: The Udyam Flex Loan app is available in major app stores.

- Fill in Personal & Business Details: Provide the necessary information about yourself and your business.

- Upload Business Documents: Submit the required documents for verification.

Once your verification is complete, you can access the funds instantly, allowing you to use the money to grow your business right away.