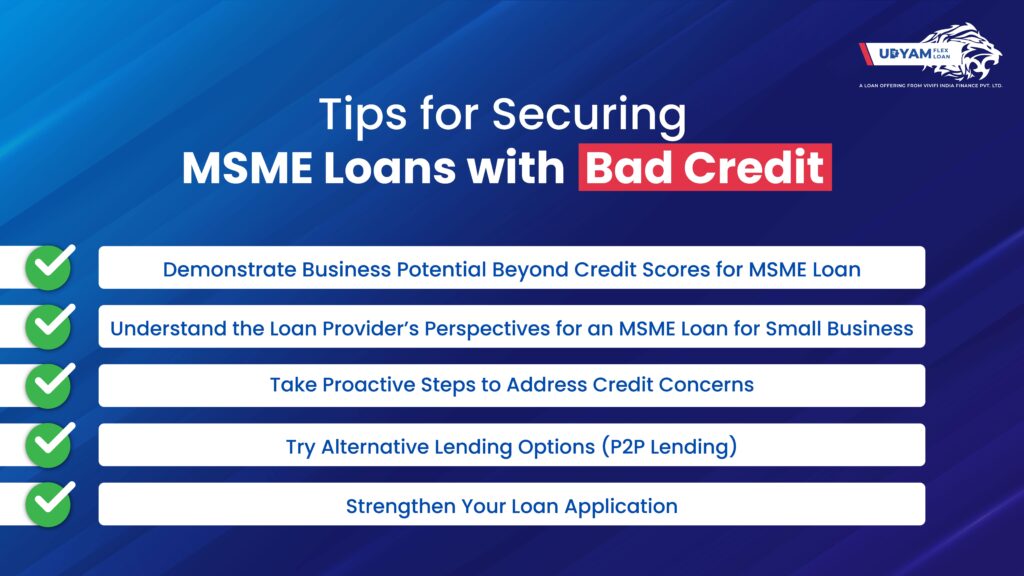

Tips for Securing MSME Loans with Bad Credit

For Micro, Small, and Medium Enterprises (MSMEs), access to financing is often crucial for growth, expansion, and even day-to-day operations. However, when faced with a less-than-perfect credit history, many businesses struggle to secure an MSME loan. By understanding loan providers’ perspectives and taking proactive steps to address credit concerns, getting an MSME Loan for Small Business becomes easier.

Understanding the Challenges in Getting an MSME Loan

Credit providers use credit scores as a primary indicator of financial responsibility and loan repayment likelihood. A low credit score suggests higher risk. It makes traditional loan providers hesitant to approve an MSME loan for New Businesses or to offer less favorable terms.

However, it’s crucial to remember that credit scores are just one piece of the puzzle. Many MSME financing facilities are willing to look beyond credit scores. It is possible only if other aspects of your business demonstrate potential and reliability.

Tips for Securing MSME Loans with Bad Credit

1. Demonstrating Business Potential Beyond Credit Scores for MSME Loan for New Business: When your credit score doesn’t tell the whole story, focus on showcasing other aspects of your business’s potential.

- Industry Experience:Highlight the expertise and track record in your field to get an MSME Loan. This can include years of experience, relevant education, or industry recognition.

- Strong Management Team: If your business has partners or key employees with strong credentials, emphasize their roles and expertise.

- Market Opportunity: Clearly articulate your business’s unique value proposition and the market you’re addressing.

- Growth Trajectory: If your business is showing consistent growth, even if it’s modest, make sure to highlight this trend.

- Customer Base: A loyal customer base or long-term contracts can demonstrate stability and future income potential.

2. Understanding The Loan Provider’s Perspectives for an MSME Loan for Small Business: To improve your chances of loan approval, understand what loan providers are looking for:

- Ability to Repay: This is the primary concern for any provider. Be prepared to show how your business generates the cash flow to make loan payments.

- Character: providers want to work with trustworthy borrowers. Be honest about the financial history and challenges of your business.

- Capital: The amount of skin you have in the game matters. Be prepared to make a significant down payment if possible.

- Conditions: External factors like market conditions and industry trends can influence the decision for your MSME Loan for Small Business. Be prepared to discuss how these factors affect your business.

3. Proactive Steps to Address Credit Concerns: Taking the initiative to address credit issues can demonstrate responsibility to providers:

- Be Upfront About Past Issues: If there are specific reasons for credit challenges (e.g., a one-time event or past mistake), explain the circumstances and how your business has addressed them.

- Show a Plan for Improvement: Develop and share a concrete plan for improving your credit over time to get the MSME Loan for Small Business or for bad credit.

- Offer Additional Guarantees: Consider bringing in a co-signer or offering personal guarantees to increase provider confidence.

- Start Small: Start with a smaller MSME loan amount to build a positive repayment history before seeking larger amounts.

4. Other Lending Options: When traditional bank loans seem out of reach, consider these alternative lending options:

- Microfinance Institutions (MFIs): These organizations specialize in providing small loans to businesses that may not qualify for traditional bank financing.

- Invoice Financing: If your business has outstanding invoices, you can use these as collateral to secure a short-term MSME Loan.

- Equipment Financing: For businesses needing to purchase equipment, some providers offer loans specifically for this purpose, using the equipment itself as collateral.

5. Strengthening Your Loan Application: Even with alternative options, you’ll want to present the strongest possible loan application. Here are some strategies to consider:

- Improve Your Credit Score: While this takes time, even small improvements can make a difference. Pay bills on time, reduce credit card balances, and correct any errors on your credit report.

- Separate Personal and Business Finances: If you haven’t already, establish separate bank accounts and credit lines for your business. This demonstrates financial organization and can protect your credit from business setbacks.

- Provide Collateral: Offering assets as collateral can offset the risk for providers and improve your chances of approval for an MSME Loan for Small Businesses.

- Develop a Solid Business Plan: A comprehensive, well-researched business plan shows providers that you’ve thought through your business strategy and understand your market.

- Demonstrate Strong Cash Flow: If possible, show consistent or growing revenue streams. This can be more important to some providers than credit scores.

Credit score is not a reflection of your journey and doesn’t reflect negatively on your creditworthiness

Securing MSME loans with bad credit is challenging but not impossible. By exploring alternative lending options, strengthening your loan application, demonstrating your business’s potential beyond credit scores, and taking proactive steps to address credit concerns, you can significantly improve your chances of approval.

When you’re seeking an MSME Loan to grow your small business, even with a less-than-perfect credit score, the Udyam Flex Loan could be the ideal solution.This loan is exclusively designed for businesses with great potential to grow but has a limited operational history. Using the credit support from this loan, you can invest in the expansion of the business operations and workforce. From working capital to equipment financing, this loan can be the fastest way to meet the monetary needs of your business. To enjoy the relaxed eligibility criteria and other benefits it offers, visit its website to apply now!