Why MSME Business Loans Are Vital for Small Entrepreneurs

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of many economies worldwide. They significantly contribute to GDP, employment, and regional development. In India, MSMEs contribute nearly 30% to the GDP and provide jobs to over 110 million people. Despite their importance, MSMEs often face challenges in accessing funds, which can hinder their growth and innovation. This is where MSME business loans, such as the Udyam Flex Loan by Vivifi, become essential, offering the financial support needed for these enterprises to expand, innovate, and stay competitive.

7 Reasons Why MSME Business Loans Are Vital for Small Entrepreneurs

Here are seven compelling reasons why MSMEs should consider a business loan:

1. Enhancing Business Operations

Funds from a business loan can be pivotal in improving and optimizing operations. Whether it’s investing in new machinery, upgrading technology, or enhancing supply chain management, a business loan can provide the resources needed for these advancements. By streamlining operations, MSMEs can achieve greater efficiency and profitability, which is crucial for sustaining long-term growth.

2. Scaling the Business

When an MSME is ready to scale, additional capital is often required. A business loan can facilitate expansion plans, whether it’s opening new branches, entering new markets, or increasing production capabilities. With the right funding, MSMEs can scale their operations effectively, tapping into new opportunities and growing their market presence.

3. Managing Working Capital

Effective management of cash flow is essential for any business, and MSMEs are no exception. Business loans provide the necessary working capital to cover day-to-day operational expenses, ensuring that the business can run smoothly without financial disruptions. This financial cushion allows MSMEs to maintain their operations and meet their financial obligations without stress.

4. Investing in Technology

In today’s digital world, staying competitive requires continual investment in technology. Business loans can support MSMEs in adopting the latest tools and software, from customer relationship management (CRM) systems to e-commerce platforms. This technological investment helps businesses stay relevant, improve operational efficiency, and meet customer expectations.

5. Diversifying Offerings

Expanding product lines or services can open up new revenue streams for MSMEs. A business loan can provide the funds needed to research, develop, and launch new offerings. By diversifying their products or services, MSMEs can better compete in the market, attract a broader customer base, and drive additional revenue.

6. Tackling Unforeseen Expenses

Unexpected expenses, such as market fluctuations, equipment breakdowns, or emergencies, can strain an MSME’s finances. A business loan acts as a financial cushion, helping businesses navigate these challenges without disrupting their operations. Having access to funds in times of need ensures that MSMEs can manage unforeseen costs effectively.

7. Building Business Credit

Taking out and repaying a business loan on time can significantly improve an MSME’s credit profile. A strong credit history makes it easier to secure future financing under better terms, supporting long-term growth and stability. Building a positive credit history is crucial for MSMEs looking to access larger amounts of capital in the future.

MSME Loans Made Easy with Udyam Flex Loan

For those seeking a business loan, the Udyam Flex Loan offered by Vivifi India Finance Pvt. Ltd. is a practical option. Tailored to empower entrepreneurs across various sectors, this loan provides a hassle-free way to access up to ₹10 lakhs. With interest rates ranging from 18% to 48% and tenures between 6 to 18 months, it offers a flexible solution for MSMEs.

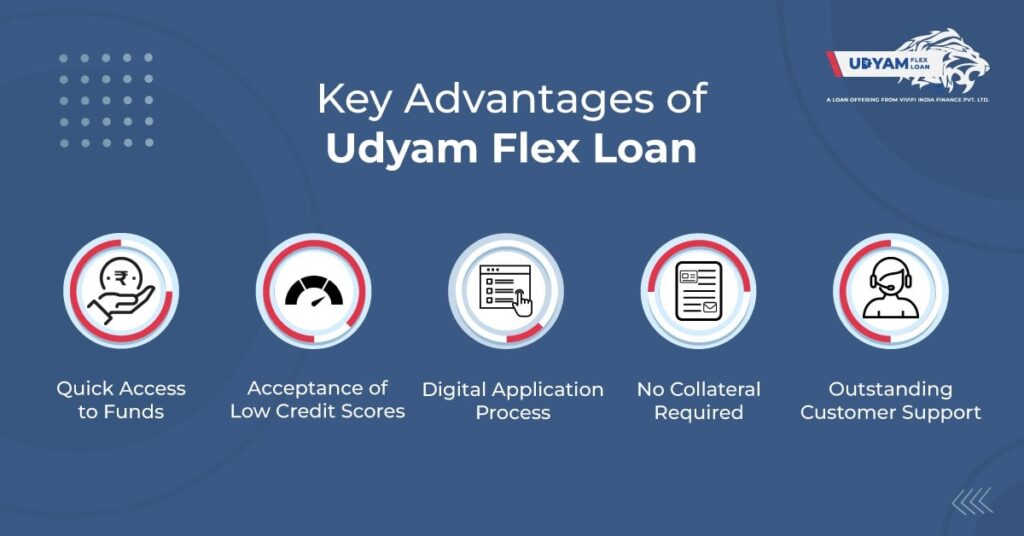

Benefits of the Udyam Flex Loan include:

- Easy Access to Funds: Obtain loans of up to ₹10 lakhs without the complex procedures typical of traditional loans.

- Low Credit Score Accepted: Even with a credit score of 500+, you can qualify for a loan, making it accessible to a wider range of small business owners.

- Fully Digital Application: The application process is entirely online, ensuring speed and convenience.

- No Collateral Needed: No collateral is required, reducing the risk for borrowers.

- Excellent Customer Support: Udyam Flex Loan provides outstanding customer service to assist you throughout the loan process.

Also read: How MSME Business Loans Can Benefit Your Startup

Bottom Line

MSMEs are crucial to economic growth, yet they often face financial challenges that can hinder their development. Business loans, like the Udyam Flex Loan by Vivifi, offer a vital lifeline, enabling these enterprises to grow, innovate, and thrive. By understanding the strategic benefits of business loans, MSMEs can make informed decisions that support their long-term success. With the right financial support, small entrepreneurs can unlock their full potential and drive their businesses toward a prosperous future.