MSME 45-Days Payment Rule

The Finance Act 2023 introduced Section 43B(h) to help improve the financial situation of Micro, Small, and Medium Enterprises (MSMEs) in India. This section allows buyers to deduct payments owed to micro and small enterprises for goods and services within the same year, as long as the payments are made within the deadline set by the Micro, Small, and Medium Enterprises Development Act, 2006.

Starting from April 1, 2024, this change aims to solve the problem of working capital shortages and promote timely payments to MSMEs.

In this blog, we’ll explain the MSME 45-day payment Rule, its effects, and its impact on MSME suppliers and buyers, and explore how the Udyam Flex Loan can help MSMEs manage their finances effectively.

What is the MSME 45-Day Payment Rule?

MSME New Payment Rule, stipulated in Section 43B(h) of the Income Tax Act, mandates that buyers must settle payments owed to MSME suppliers within 45 days from the date of acceptance of goods or services. Here are the key points:

- MSME 45 days payment rule Applicability:

- This rule applies specifically to transactions between MSMEs (Micro, Small, and Medium Enterprises) and their buyers.

- It is relevant for all businesses dealing with MSME suppliers, regardless of the business size or sector.

- Timely Payments:

- Buyers are legally obligated to make payments within the specified timeframe. Delayed payments can have severe consequences for both parties.

- Payments made within 45 days are eligible for tax deductions in the same financial year. Payments made after this period can only be claimed as deductions in the financial year they are actually paid.

- Financial Stability for MSMEs:

- The primary objective of this rule is to ensure the financial stability of MSMEs. Timely payments allow these small businesses to manage their cash flow efficiently.

Implications and Benefits

For MSME Suppliers:

- Cash Flow Management: MSMEs often operate on tight budgets. The MSME 45-Day Payment Rule ensures that they receive payments promptly, allowing them to meet operational expenses, pay employees, and invest in growth.

- Reduced Dependency on Borrowing: When payments are delayed, MSMEs may resort to borrowing or credit lines to bridge the gap. The rule minimizes this dependency, promoting self-sufficiency.

- Business Confidence: Knowing that buyers must adhere to the 45-day timeline boosts the confidence of MSMEs in their business relationships.

For Buyers:

- Compliance and Legal Consequences: Non-compliance with the rule can result in legal penalties. Buyers risk facing fines or other punitive measures if they fail to pay within the stipulated period.

- Supplier Relationships: Adhering to the payment timeline fosters positive relationships with suppliers. Trust and reliability are essential for long-term partnerships.

Non-compliance Penalties

Non-compliance with the MSME 45-Day Payment Rule can result in several penalties:

- Fines: Buyers who fail to make payments within the stipulated 45-day period may face monetary fines, the amount of which depends on the severity of the delay and local regulations.

- Legal Proceedings: MSME suppliers have the right to initiate legal proceedings against non-compliant buyers, potentially leading to costly litigation.

- Blacklisting: Repeated violations may result in buyers being blacklisted by MSMEs or industry associations, significantly impacting their ability to engage in business transactions.

- Interest Charges: Some jurisdictions allow MSME suppliers to charge interest on delayed payments. Buyers may be liable for additional interest beyond the original invoice amount.

- Contractual Consequences: Contracts between buyers and suppliers often include clauses related to payment timelines. Non-compliance may trigger penalties specified in the contract.

How Udyam Flex Loan Benefits MSMEs Under the 45-Day Payment Rule

Udyam Flex Loan, offered by Vivifi India Finance Pvt. Ltd provides small businesses with loans up to ₹10 lakhs, designed to meet their urgent capital needs. With flexible terms and interest rates between 18% and 48%, it supports MSMEs by aligning with the 45-day payment rule.

This ensures timely payment cycles, helping businesses maintain healthy cash flow and operational efficiency. By adhering to this rule, MSMEs can avoid financial strain and continue to grow and thrive.

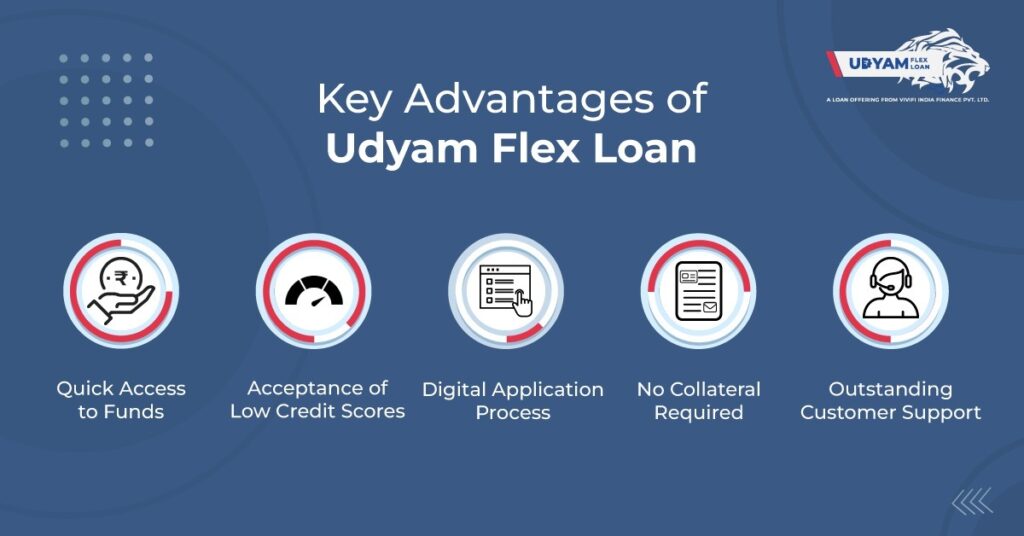

Key Advantages of Udyam Flex Loan

- Quick Access to Funds: Secure loans up to ₹10 lakhs without the complexities associated with traditional loans.

- Acceptance of Low Credit Scores: Even with a low credit score, you can qualify for a loan, broadening accessibility for shop owners.

- Digital Application Process: Enjoy a fully online application process, ensuring speed and convenience.

- No Collateral Required: There’s no need to pledge collateral, reducing your risk exposure.

- Outstanding Customer Support: Benefit from excellent customer service throughout your loan journey with Udyam Flex Loan.

Eligibility Requirements

- Minimum operational history of 6 months for your business

- Proof of business registration

- Minimum monthly turnover of ₹30,000

How to Apply for Udyam Flex Loan

Applying for a Udyam Flex Loan is easy and can be done in just three simple steps:

- Download the App: Get the Udyam Flex Loan app from your preferred app store.

- Provide Personal & Business Details: Fill in essential information such as your name, address, type of business, and MSME/Udyam Registration number.

- Upload Business Documents: Submit required documents like Aadhaar or PAN, bank statements, and ITR returns.

After verification, you’ll receive a loan offer. Complete the VKYC (Video Know Your Customer) verification, and once approved, you’ll have instant access to funds to help scale your business.

Conclusion:

The MSME 45-Day Payment Rule in India is a game-changer, ensuring timely payments from buyers. This helps small businesses manage cash flow better and reduces their need to take on debt, keeping operations smooth and fostering growth. For buyers, compliance avoids fines and legal troubles, building trust-based relationships with suppliers.

The Udyam Flex Loan from Vivifi India Finance Pvt. Ltd. offers a lifeline for MSMEs, providing quick, flexible funding options to stay afloat and thrive under the 45-day Payment Rule. With an easy application process and no collateral required, it’s an ideal solution for managing financial needs and ensuring business stability.