What is the Minimum CIBIL Score for Business Loans?

When applying for a business loan, one of the critical factors loan providers consider is your CIBIL score. But what exactly is a CIBIL score, and what is the minimum CIBIL score for business loans? Let’s delve into the details and explore why this score is so crucial for entrepreneurs and business owners seeking business loans.

What is a CIBIL Score?

CIBIL, which stands for Credit Information Bureau (India) Limited, is a credit rating agency that maintains records of individuals’ and businesses’ credit-related activities, such as loans and credit cards. Your CIBIL score is a three-digit number ranging from 300 to 900, reflecting your creditworthiness. The higher the score, the more likely you are to be approved for loans at favorable terms.

Why CIBIL Score Matters for Business Loans

Loan providers use the CIBIL score as a primary criterion to assess the risk of lending money. A higher score indicates that the borrower has a history of timely repayments and responsible credit behavior, reducing the loan provider risk. For business loans, which often involve larger amounts and longer repayment periods, a good CIBIL score can be even more critical.

Minimum CIBIL Score for Business Loans

The minimum CIBIL score required for business loans can vary depending on the loan provider and the specific loan product. Generally, most banks and non-banking financial companies (NBFCs) look for a CIBIL score of at least 650. However, a score of 700 or above is often preferred, as it opens up more loan options with better interest rates and terms.

Here’s a breakdown of how different CIBIL score ranges can impact your business loan application:

| CIBIL Score Range | Assessment | Loan Availability | Terms |

| Below 600 | Poor | Extremely challenging to secure a loan | High-interest rates and stringent terms if approved |

| 600-649 | Fair | Limited options | Unfavorable terms |

| 650-699 | Good | Most loan providers will consider the application | May not qualify for the best interest rates |

| 700-749 | Very Good | Wide range of loan products available | Competitive interest rates and favorable terms |

| 750 and above | Excellent | The best chance of securing loans | Most favorable terms |

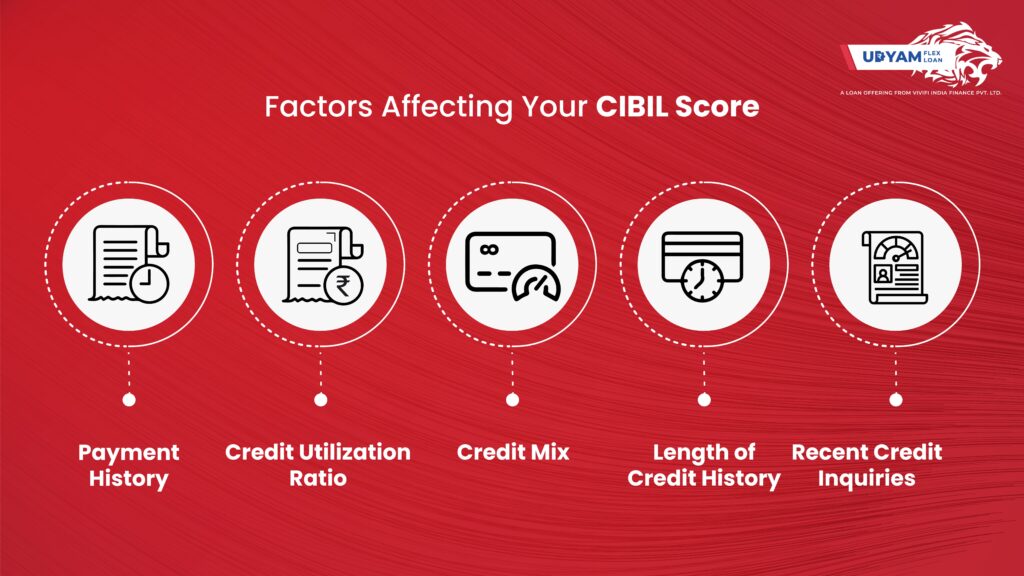

Factors Affecting Your CIBIL Score

Several factors influence your CIBIL score. Understanding these can help you maintain or improve your score:

- Payment History: Timely repayment of loans and credit card bills has the most significant impact on your score.

- Credit Utilization Ratio: This is the ratio of your current credit balance to the total credit limit available. Keeping this ratio low positively impacts your score.

- Credit Mix: Having a mix of secured (like home loans) and unsecured (like credit cards) credit can benefit your score.

- Length of Credit History: The longer your credit history, the better. It shows loan provider your experience in handling credit.

- Recent Credit Inquiries: Multiple inquiries for new credit can negatively impact your score, as it suggests higher credit dependency.

Improving Your CIBIL Score for Business Loans

If your CIBIL score is not where you want it to be, don’t worry. There are steps you can take to improve it:

- Pay On Time: Ensure all your loan EMIs and credit card bills are paid on time.

- Lower Your Credit Utilization: Try to keep your credit utilization ratio below 30%.

- Avoid Multiple Loans: Don’t apply for multiple loans simultaneously. Each inquiry can lower your score.

- Regularly Check Your Credit Report: Ensure there are no errors in your credit report. If you find any discrepancies, report them to CIBIL for correction.

- Maintain a Healthy Credit Mix: Aim for a balanced mix of secured and unsecured loans.

Factors Beyond the CIBIL Score

While your CIBIL score is crucial, it’s not the only factor loan provider consider. Here are other aspects that come into play:

- Business Revenue: A healthy, consistent income can sometimes offset a lower CIBIL score.

- Years in Business: Established businesses might get more leeway than startups.

- Debt-to-Income Ratio: Lower is better, showing you can manage additional debt.

- Collateral: Secured loans might be available with lower scores.

- Industry Type: Some industries are considered riskier than others.

- Purpose of Loan: The reason for borrowing can influence the decision.

What If Your CIBIL Score Is Bad?

Don’t panic if your score isn’t in the ideal range. Here are some steps you can take:

- Check for Errors: Sometimes, your CIBIL report might have mistakes. Review it carefully and report any errors.

- Improve Your Score: Pay bills on time, reduce credit utilization, and avoid applying for multiple loans simultaneously.

- Consider Alternative Loan provider: NBFCs and fintech companies often have more flexible criteria.

- Secured Loans: Offering collateral can increase your chances of approval.

- Get a Co-applicant: A business partner or family member with a strong credit score can boost your application.

- Build Your Business Credit: Separate from personal credit, a strong business credit profile can help.

Types of Business Loans and Their CIBIL Score Requirements

Different types of business loans might have varying CIBIL score requirements:

- Term Loans: Usually require higher scores, often 700+.

- Working Capital Loans: Might be more flexible, sometimes considering scores of 650+.

- Equipment Financing: Often more lenient, as the equipment serves as collateral.

- Business Credit Cards: Generally require higher scores, often 720+.

- Startup Loans: May focus more on the business plan and potential than CIBIL score.

Also read How to choose the Right MSME Business Loan Companies

Udyam Flex Loan: Empowering Entrepreneurs with Min CIBIL Score for Business Loan

For those seeking a business loan, the Udyam Flex Loan offered by Vivifi India Finance Pvt. Ltd is a viable option. Tailored to empower entrepreneurs across various sectors, this loan provides a hassle-free way to access up to ₹10 lakhs, with interest rates ranging from 18% to 48% and tenures between 6 to 18 months. The benefits of Udyam Flex Loan include:

- Easy Access to Funds: Obtain loans of up to ₹10 lakhs without the complex procedures typical of traditional loans.

- Low Credit Score Accepted: Even with a credit score of 500+, you can qualify for a loan, making it accessible to a wider range of shop owners.

- Fully Digital Application: The application process is entirely online, ensuring speed and convenience.

- No Collateral Needed: No collateral is required, reducing the risk for borrowers.

- Excellent Customer Support: Udyam Flex Loan provides outstanding customer service to assist you throughout the loan process.

Understanding and managing your CIBIL score is essential for securing business loans on favorable terms. By maintaining good credit habits and being aware of your financial activities, you can improve your chances of obtaining the funds needed to grow your business.