Key Financial Tips for Women Entrepreneurs

growth is immense. However, understanding the financial system can be challenging.Whether you’re just starting or looking to expand your existing venture, a solid financial strategy is crucial. Here are some key financial tips to help you succeed, including insights on securing a business loan online for women in India.

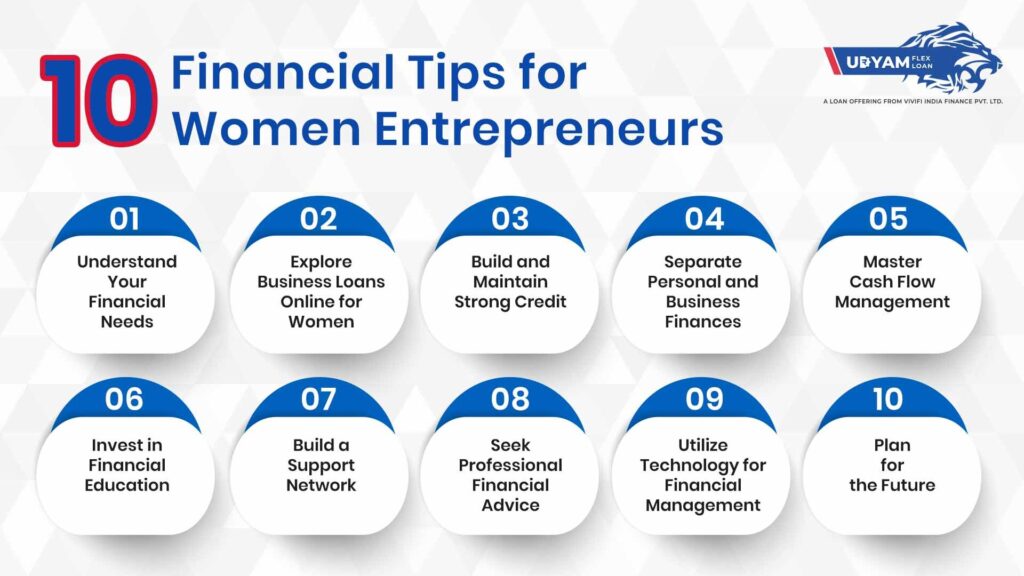

10 Financial Tips for Women Entrepreneurs

1. Understand Your Financial Needs

Start by assessing your financial needs. Create a detailed business plan outlining your goals, expenses, and projected revenues. This plan will guide your business operations and be crucial when applying for loans or seeking investors. Knowing your financial needs helps you make informed decisions about funding and resource allocation.

2. Explore Business Loans Online for Women

Many financial institutions offer business loans tailored for women entrepreneurs with favorable terms, lower interest rates, and flexible repayment options. Utilize online platforms that connect women business owners with lenders. Compare offers from multiple lenders to find the best fit for your business goals and financial capacity.

3. Build and Maintain Strong Credit

A strong credit score is vital for securing favorable loan terms. Maintain good credit by paying bills on time, keeping credit card balances low, and regularly monitoring your credit report for errors. A solid credit score not only improves your chances of loan approval but also helps you negotiate better interest rates and terms.

4. Separate Personal and Business Finances

Keep your personal and business finances separate by opening a dedicated business bank account. Use it exclusively for business transactions. This separation simplifies accounting, helps track business expenses, and provides a clear picture of your business’s financial health. It also adds credibility when applying for loans or dealing with vendors and clients.

5. Master Cash Flow Management

Effective cash flow management is crucial for any successful business. Develop a system to monitor your cash flow regularly, including tracking revenue, managing accounts receivable, and controlling expenses. Consider using accounting software to streamline this process. Good cash flow management ensures you have enough funds to cover operating expenses, invest in growth opportunities, and handle unexpected costs.

6. Invest in Financial Education

Empower yourself with financial knowledge. Take advantage of workshops, online courses, and seminars focused on business finance and management. Organizations like SCORE and local Small Business Development Centers offer free or low-cost resources. Understanding financial statements, budgeting, and tax planning equips you to make sound financial decisions.

7. Build a Support Network

Networking with other women entrepreneurs can provide invaluable support and insights. Join local business groups, attend networking events, and participate in online forums. These connections can lead to mentorship opportunities, potential partnerships, and shared experiences that guide your financial decision-making.

8. Seek Professional Financial Advice

Consult with a financial advisor or accountant for expert guidance tailored to your business needs. Professionals can help with tax planning, investment strategies, and long-term financial planning. Their expertise can save you time and money, allowing you to focus on growing your business.

9. Utilize Technology for Financial Management

Leverage technology to streamline your financial management processes. Use accounting software to track expenses, manage invoices, and generate financial reports. Many solutions offer features like automated bookkeeping, tax preparation, and cash flow forecasting, which can save you time and reduce errors.

10. Plan for the Future

While managing day-to-day finances is crucial, also plan for the long term. Set aside funds for emergencies, invest in retirement plans, and consider strategies for business expansion. Regularly review and update your business plan to reflect changing market conditions and evolving business goals.

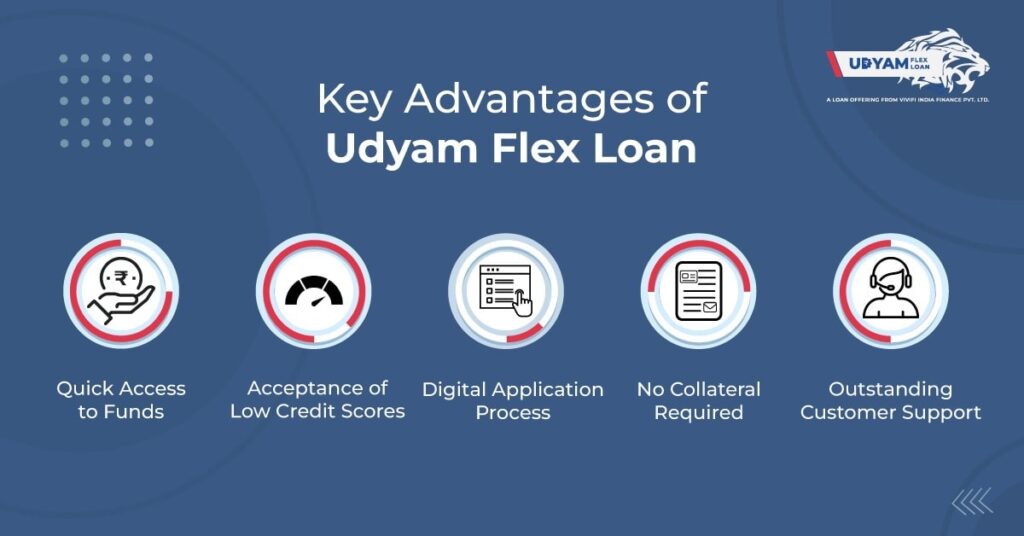

Udyam Flex Loan: A Tailored Solution for Women Entrepreneurs

For women entrepreneurs seeking flexible funding solutions, the Udyam Flex Loan offered by Vivifi India Finance Pvt. Ltd. can be a game-changer. Designed to empower Micro, Small, and Medium Enterprises (MSMEs) across various sectors, including manufacturing, services, retail, construction, healthcare, and more. We aim to provide hassle-free financial support. Here are its key features:

Features of Udyam Flex Loan

1. Easy Access to Funds:

- Loan Amount: Obtain loans up to ₹10 lakhs, providing substantial financial support without the complex procedures typical of traditional loans.

- Fast Disbursal: Funds are disbursed quickly after the verification process, allowing businesses to access the capital they need without delay.

2. Low Credit Score Accepted:

- Credit Score Flexibility: Even with a credit score of 500+, you can qualify for a loan. This feature makes the Udyam Flex Loan accessible to a wider range of entrepreneurs who might struggle to secure funding from traditional lenders.

3. Fully Digital Application:

- Online Process: The entire application process is conducted online, ensuring speed and convenience. There is no need for lengthy paperwork, making it easy for busy entrepreneurs to apply.

4. No Collateral Needed:

- Unsecured Loan: The Udyam Flex Loan does not require any collateral, reducing the risk for borrowers and making it easier for businesses to obtain funding.

5. Flexible Tenure and Interest Rates:

- Tenure Options: Choose a repayment period that suits your business needs, with tenures ranging from 6 to 18 months.

- Interest Rates: Competitive interest rates ranging from 18% to 48%, allowing businesses to manage their repayment schedules effectively.

6. Excellent Customer Support:

- Assistance Throughout the Process: Udyam Flex Loan provides outstanding customer service to assist borrowers at every stage of the loan process, ensuring a smooth and supportive experience.

7. Minimal Documentation Required:

- Simplified Requirements: The documentation needed for the loan application is minimal, including basic personal and business documents such as identity proof, address proof, business registration proof, and recent bank statements.

Eligibility Criteria for Udyam Flex Loan

To benefit from the Udyam Flex Loan, MSMEs must meet the following eligibility criteria:

- Minimum Business Operational History: 6 months

- Business Registration Proof: Required

- Minimum Monthly Turnover: ₹30,000

How to Apply for Udyam Flex Loan

Applying for a Udyam Flex Loan is straightforward and can be done in three simple steps:

- Download the App: The Udyam Flex Loan app is available in major app stores.

- Fill in Personal & Business Details: Provide the necessary information about yourself and your business.

- Upload Business Documents: Submit the required documents for verification.

Once your verification is complete, you can access the funds instantly, allowing you to use the money to grow your business right away.

Conclusion

Women entrepreneurs are truly remarkable. Your passion, creativity, and determination light up the business world. By taking charge of your finances, you’re not just running a business – you’re building a legacy. Take time to understand your finances, explore business loans online for women in India, and implement good financial practices. These steps will help you build a strong foundation for your business.

Consider the Udyam Flex Loan, a tailored solution to support the unique needs of women entrepreneurs in India, providing them with the financial flexibility required to start, sustain, and grow their businesses. Explore this option to empower your entrepreneurial journey and achieve your business goals.

Your success as an entrepreneur contributes not only to your own growth but also to India’s economy.