Can A Business Loan affect your Personal Credit Score?

Simultaneously, personal credit awareness has skyrocketed. Credit bureau TransUnion CIBIL reports that 78% of Indian adults now actively monitor their credit scores. This convergence raises a critical question for entrepreneurs and small business owners: Can a business loan affect your personal credit score? The answer is nuanced and depends on various factors. These factors can be the type of business entity, loan structure, and personal guarantees – all of which have become more complex in India’s post-pandemic economic recovery.

Instant MSME Loan

An Instant MSME Loan is a quick-access financing solution designed specifically for Micro, Small, and Medium Enterprises in India. These loans leverage digital technology and alternative credit assessment methods to provide rapid approval and disbursement of funds, often within 24-72 hours. As of 2024, instant MSME loans offer amounts ranging from ₹50,000 to ₹5 crore, with minimal documentation requirements.

Key features include:

- Digital application process

- Use of AI and big data for credit evaluation

- Flexible collateral requirements

- Competitive interest rates (usually 10-16% p.a.)

- Short to medium-term tenures (3 months to 5 years)

You can find all these great features in Udyam Flex Loans for MSMEs. This loan caters to various business needs such as working capital, equipment purchase, or expansion. The rapid processing makes it suitable for addressing urgent financial requirements or capitalizing on time-sensitive business opportunities.

Can A Business Loan Affect Your Personal Credit Score?

The impact of a business loan on your credit score depends largely on the structure of your business and the type of loan you’ve obtained. Here are the key points to consider:

-

Business Structure:

-

-

- Sole proprietorships and partnerships: In these cases, the business and the owner are considered the same entity. Business loans will likely appear on your credit report and affect your score.

- Corporations and LLCs: Generally, business loans for these entities are separate from personal finances and won’t directly impact your credit score.

-

-

Personal Guarantee: If you’ve personally guaranteed a business loan, it can affect your credit score regardless of business structure. This makes you responsible for repayment.

-

Credit Checks: When applying for an instant MSME loan, lenders may perform a hard inquiry on your credit, which can temporarily lower your score.

-

Payment History: For loans that do appear on your personal credit report, timely payments can positively impact your score, while late payments can harm it.

-

Credit Utilization: If the instant MSME loan increases your credit utilization ratio, it might negatively affect your score.

-

Building Business Credit: Responsibly managing a business loan can help build your business credit profile, which may reduce the need to rely on personal credit for future business financing.

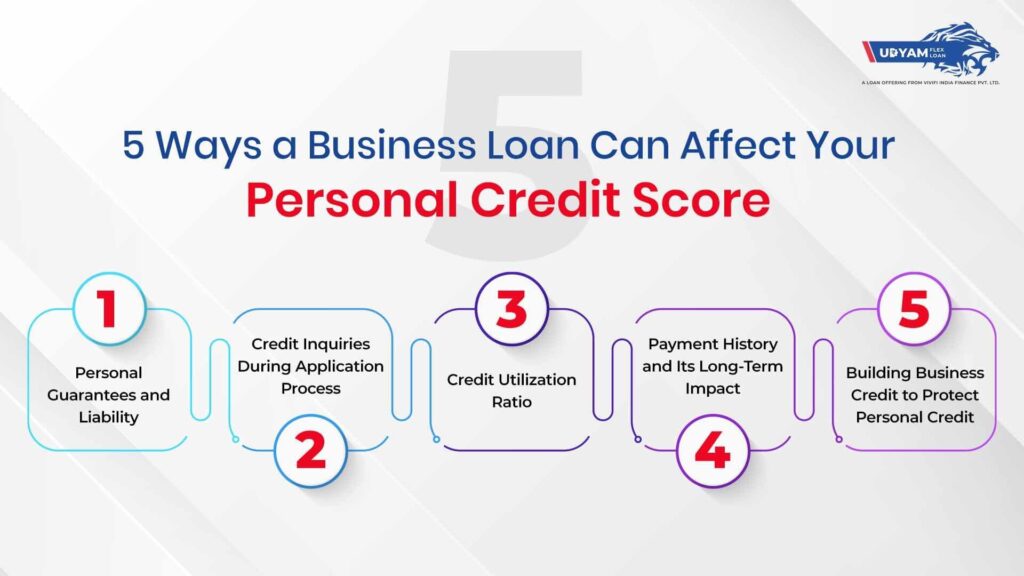

5 Ways a Business Loan Can Affect Your Personal Credit Score

1. Personal Guarantees and Liability

When you take out the Udyam Flex Loan for MSMEs or any business loan with a personal guarantee, you’re essentially putting your credit on the line. This is common for small businesses, especially sole proprietorships and partnerships. As of 2024, about 60% of small business loans in India require personal guarantees. If your business defaults on the loan, it will negatively impact your personal credit score. Conversely, timely payments can positively affect your score.

2. Credit Inquiries During Application Process

Applying for a business loan often involves a hard inquiry on your personal credit report. Each inquiry can temporarily lower your credit score by a few points. In 2024, the average impact of a hard inquiry in India is a 5-10 point reduction in your CIBIL score. Multiple inquiries in a short period can have a compounding effect, so it’s wise to shop for loans strategically.

3. Credit Utilization Ratio

If your Udyam Flex Loan for MSMEs or any other MSME loan is linked to your personal credit, it can affect your credit utilization ratio. The amount of credit you’re using compared to your credit limits. High utilization can negatively impact your score. As a rule of thumb, keeping your credit utilization below 30% is advisable. In 2024, the average credit utilization ratio for Indian small business owners is around 40%, indicating room for improvement.

4. Payment History and Its Long-Term Impact

Your payment history on a business loan can significantly influence your personal credit score if the loan is personally guaranteed or taken under your name. Consistent, on-time payments can boost your score, while late payments or defaults can severely damage it. In India, payment history accounts for about 35% of your CIBIL score calculation as of 2024.

5. Building Business Credit to Protect Personal Credit

Establishing a strong business credit profile can help separate your business finances from your personal credit. This can protect your personal score from being affected by instant MSME loans in the future. In 2024, only about 20% of Indian MSMEs have a separate business credit score, highlighting a significant opportunity for improvement. Building business credit involves steps like incorporating your business, obtaining a business PAN, and establishing credit accounts in your business name.

While Instant MSME loans can impact your personal credit score under certain circumstances, the extent of this impact largely depends on the loan structure and your business entity type. It’s crucial for entrepreneurs to carefully consider these factors when seeking business financing.

One innovative solution addressing this concern is the Udyam Flex Loan for MSMEs. This scheme is designed specifically for MSMEs registered under the Udyam portal. It offers flexible credit options without mandating personal guarantees for loans up to ₹10 lakhs.

By utilizing this tailored financial solution and maintaining a clear distinction between personal and business finances, entrepreneurs can protect their personal credit scores while still accessing the capital needed for business growth.