How Can Green Financing Empower MSMEs to Build Sustainable Ventures?

Table of Contents:

Sustainability is no longer just a buzzword; it has become a necessity for businesses aiming to thrive in an increasingly eco-conscious market. As environmental concerns grow, companies are shifting toward greener practices to reduce their ecological footprint. This has led to the rise of green businesses and organizations that prioritize environmental responsibility alongside profitability. However, transitioning to green operations often requires financial support, which is where green financing comes in. Green business loans offer an excellent opportunity for companies to invest in eco-friendly infrastructure, technologies, and sustainable practices.

What is Green Business?

A green business integrates sustainable practices across its operations. It is the amalgamation of energy consumption and waste management in production methods and supply chains. These businesses aim to reduce their carbon footprint while promoting social responsibility. Whether a small startup or a multinational corporation, a green business adopts renewable energy sources, recycles materials, and minimizes its impact on the environment. In India, the push toward eco-friendly industries is becoming more pronounced, as consumers and policymakers alike are increasingly supporting companies that are sustainable and socially responsible.

What is Green Financing?

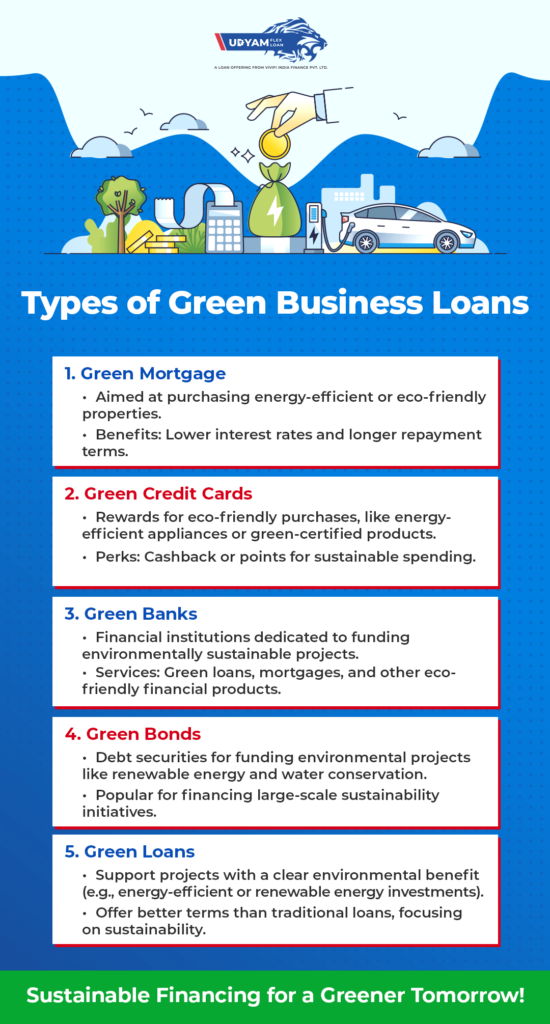

Green financing refers to funding designed to support projects that contribute to environmental sustainability. This includes initiatives aimed at reducing carbon emissions, conserving natural resources, and promoting clean energy. Green finance provides capital for businesses and individuals looking to invest in eco-friendly infrastructure, renewable energy technologies, or sustainable practices. For businesses, securing a green loan can help finance the purchase of energy-efficient machinery, the construction of sustainable buildings, or the implementation of recycling programs.

In India, the green finance sector is rapidly evolving, with both public and private banks offering tailored financial products for businesses committed to sustainability. This shift in financing aligns with India’s goal of achieving its commitments under the Paris Agreement and transitioning to a low-carbon economy.

Green Financing is Buzzing Lately!

Here are the key benefits of choosing green financing:

- Access to specialized loans

- Boosts reputation

- Risk mitigation

- Market leadership

- Environment-friendly infrastructure, technologies, and development

Read on to explore more!

Why Choose a Green Business Loan?

As businesses grow increasingly aware of their environmental impact, more are choosing green business loans to finance eco-friendly initiatives. Green loans are specifically designed to encourage businesses to make sustainable changes, from upgrading to energy-efficient equipment to adopting cleaner production technologies.

There are several reasons to choose a green business loan:

- Sustainability Commitment: By opting for green financing, your business sends a strong signal of its commitment to environmental sustainability, which is appealing to stakeholders, investors, and consumers.

- Long-term Cost Savings: While green technology may require an upfront investment, it often leads to significant long-term savings. For instance, renewable energy solutions like solar panels or energy-efficient appliances can greatly reduce electricity costs over time.

- Government Incentives: In India, there are several government schemes and incentives designed to support green initiatives. Companies opting for green business loans may also be eligible for tax benefits and subsidies, further enhancing their financial standing.

- Access to Better Rates: Green loans often come with favorable interest rates, making it easier for businesses to invest in sustainable projects without overburdening themselves financially.

What are the Key Benefits of Choosing Green Financing?

- Access to Specialized Loans: Green financing products are tailored to specific needs, such as the purchase of renewable energy systems, eco-friendly vehicles, or sustainable building materials.

- Boosts Reputation: Securing a green loan shows that your business is taking meaningful steps to reduce its environmental impact, which can improve your reputation with customers, partners, and investors.

- Risk Mitigation: Green financing often comes with stricter environmental and sustainability criteria, helping businesses avoid the financial risks associated with regulatory changes, climate change, and resource scarcity.

- Market Leadership: Being an early adopter of sustainable practices can position your business as a leader in your industry, giving you a competitive edge.

- Environment-Friendly Infrastructure, Technologies, and Development:

- Comparative Advantage: Businesses that adopt green technologies and practices through green financing can enjoy a comparative advantage over competitors. This advantage may come from lower energy costs, tax breaks, and government incentives. Environmentally responsible companies tend to attract more customers, as well as potential investors looking to support businesses with strong environmental, social, and governance (ESG) criteria. In the long run, these benefits can translate into higher profitability and sustained growth.

- Adds to the Business Value: Green investments enhance the intrinsic value of a business. Companies that prioritize sustainability are seen as more resilient and future-ready, which increases their appeal to investors, customers, and even employees. For example, a company that integrates renewable energy into its operations can not only lower its operational costs but also differentiate itself in the marketplace as an eco-conscious brand, which adds to its market value.

- Enhanced Economic Prospects: Green financing opens the door to enhanced economic prospects by improving business efficiency and reducing dependency on non-renewable resources. Investing in energy-efficient technologies, for instance, can lead to significant cost savings over time. Businesses that adopt green practices can tap into new markets, attract a more environmentally conscious customer base, and even explore partnerships with other green enterprises.

Boost Your Business, Get Loans up to 10 Lakhs. Download Udyam Flex Loan!

Green financing enables businesses to invest in environment-friendly infrastructure, technologies, and sustainable development. This could range from green buildings and renewable energy sources like solar or wind power to energy-efficient machinery and electric vehicles. The adoption of such technologies not only helps reduce

Green Business Loans: Paving the Path to a Sustainable Future

Green business loans and green financing options play a pivotal role in driving sustainable development. As Indian businesses continue to face growing pressure to adopt eco-friendly practices, green financing provides the necessary support to make this transition smoother and more financially viable. Whether through green loans, mortgages, or bonds, there is a wide array of financial tools available to help businesses contribute to a more sustainable future while achieving economic growth.

Going green doesn’t just help protect the environment it also provides a range of economic advantages. Consumers today are more inclined to support brands that prioritize sustainability, leading to increased customer loyalty and market share. One such MSME Business loan is- the Udyam Flex Loan. It is a versatile financial solution designed to empower micro, small, and medium enterprises (MSMEs) by offering flexible financing that caters to their specific needs. This loan not only helps businesses manage working capital and expand operations but also serves as an ideal option for those seeking to transition to eco-friendly and sustainable practices. For business owners looking to invest in green infrastructure, renewable technology, or other sustainable projects, Udyam Flex Loan provides the financial backing necessary to make these environmental upgrades while ensuring smooth operations.