Business Loans for Retail MSMEs

Why do MSMEs in the Retail Industry Need Small Business Loans?

Micro, Small, and Medium Enterprises (MSMEs) play a pivotal role in the Indian economy. It is contributing significantly to the country’s GDP and employment generation. The retail industry, in particular, is a vital sector where MSMEs have a substantial presence.

However, access to capital remains a significant challenge for these entrepreneurs. It makes small business loans an essential tool for their growth and sustainability.

Why Small Business Loans Are Essential for MSME Entrepreneurs in the Retail Industry

- Finance Inventory and Stock:

Retail businesses often need a lot of capital to maintain and update their inventory. A business loan can provide the necessary funds to acquire new stock so that the store shelves never run low and the customers have various products to choose from.

- Expanding Business Operations:

As a retail business expands, its necessity to establish new branches or expand an existing store becomes inevitable. Hence, MSME loans allow leases or purchases of new premises, hiring new employees, and procuring fresh equipment.

- Investing in Technology:

Business in the contemporary world is very digital thus the role that technology plays in the success of retail businesses today is at its core. Technology investment is high and covers aspects from point-of-sale technology to sophisticated e-commerce platforms. Investment in updating technology can, therefore, allow a retailer to remain competitive.

- Marketing and Advertising:

Good marketing is key to pulling customers and increasing sales volumes. Marketing, nonetheless, does not come cheaply. It is used to seek small business loans to provide the required capital to launch and sustain marketing programs. It also supports online advertising, social media promotions, and traditional media campaigns.

- Dealing with Cash Flow:

Cash flow management is one of the fundamental aspects of running a retail business. Seasonal fluctuations in sales, unexpected expenses, or delays in customer payment can be any of the potential threats to free and regular cash flow in any retail business. A business loan can bridge such gaps, ensuring smooth operations even during rocky times.

How Udyam Flex Loan Can Help?

Udyam Flex Loan, provided by Vivifi India Finance Pvt. Ltd, is designed to support MSME entrepreneurs in many industries. These loans offer a hassle-free way to access up to ₹10 lakhs, with interest rates ranging from 18% to 48% and tenures between 6 to 18 months. The benefits of Udyam Flex Loan include:

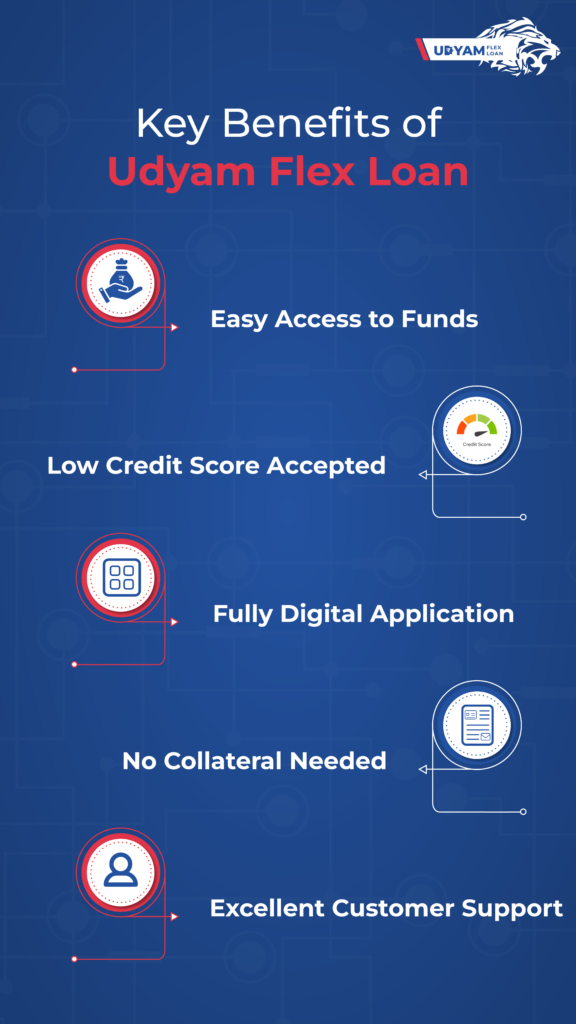

Key Benefits of Udyam Flex Loan

- Easy Access to Funds: Obtain loans of up to ₹10 lakhs without the complex procedures typical of traditional loans.

- Low Credit Score Accepted: Even with a credit score of 500+, you can qualify for a loan, making it accessible to a wider range of shop owners.

- Fully Digital Application: The application process is entirely online, ensuring speed and convenience.

- No Collateral Needed: No collateral is required, reducing the risk for borrowers.

- Excellent Customer Support: Udyam Flex Loan provides outstanding customer service to assist you throughout the loan process.

Eligibility Criteria For This MSME Loan

- Minimum Business Operational History: 6 months

- Business Registration Proof

- Minimum Monthly Turnover: ₹30,000

How to Apply for Udyam Flex Loan

Applying for a Udyam Flex Loan is straightforward and can be done in three simple steps:

- Download the App: The Udyam Flex Loan app is available in major app stores.

- Fill in Personal & Business Details: Provide the necessary information about yourself and your business.

- Upload Business Documents: Submit the required documents for verification.

Once your verification is complete, you can access the funds instantly, allowing you to use the money to grow your business right away.

Conclusion

For MSME entrepreneurs in the retail industry, MSME loans are essential for growth and success. They provide the necessary funds to keep shelves stocked, upgrade technology, and expand operations.

With Udyam Flex Loan, accessing the capital required for growth and competitiveness has never been easier. These loans empower you to seize new opportunities, adapt to market changes, and ensure long-term success. Embracing MSME small business loans is a game-changer. It allows you to navigate the dynamic retail landscape confidently and contribute to India’s booming economy. It’s not just smart—it’s essential for your future.

Don’t miss out on the opportunity to elevate your business with our hassle-free MSME business loan. Take action now and apply today!