Business Loan vs Personal Loan: Which Is Better for Small Business?

Business Loan Vs Personal Loan

Starting and running a small business often requires financial support. Two common options are business loans and personal loans, but which one is better for your small business? Approximately 63% of small business owners rely on personal loans or savings for funding. The Udyam Flex Loan offers a flexible solution, combining the benefits of both, with customizable credit lines and higher limits, to meet your business needs.

What are Business Loans?

A business loan is specifically designed to support business activities. It can be used for various purposes, such as purchasing inventory, upgrading equipment, expanding operations, or managing cash flow.

Types of Business Loans:

- Term Loans: Lump sum amounts repaid over a fixed period.

- Lines of Credit: Flexible borrowing, similar to a credit card, where interest is only paid on the amount used.

- SBA Loans: Loans backed by the Small Business Administration, often with favorable terms.

- Equipment Loans: Financing specifically for purchasing business equipment.

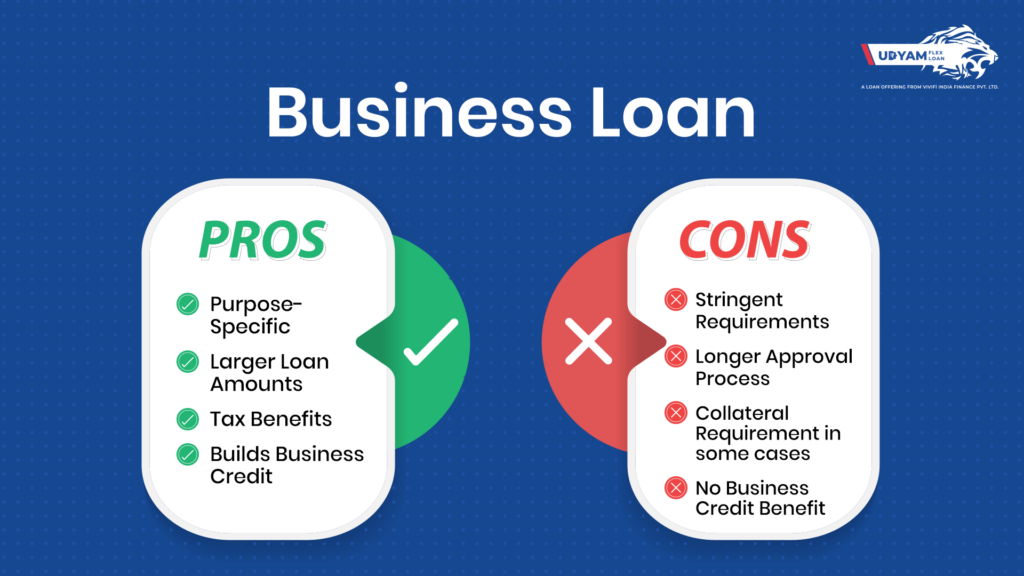

Pros of Business Loans:

- Purpose-Specific: Funds are tailored for business needs, making it easier to manage finances.

- Larger Loan Amounts: Typically, business loans offer higher amounts than personal loans.

- Tax Benefits: Interest paid on business loans can be tax-deductible.

- Builds Business Credit: Helps establish and improve the business’s credit profile.

Cons of Business Loans:

- Stringent Requirements: Often require extensive documentation, a solid business plan, and a good credit history.

- Longer Approval Process: May take longer to get approved due to the detailed assessment.

- Collateral Requirement: Some business loans require collateral, which can be risky if the business fails.

What are Personal Loans?

A personal loan is a versatile borrowing option that can be used for any purpose, including funding a small business. It involves borrowing a fixed amount and repaying it over a specified term with interest.

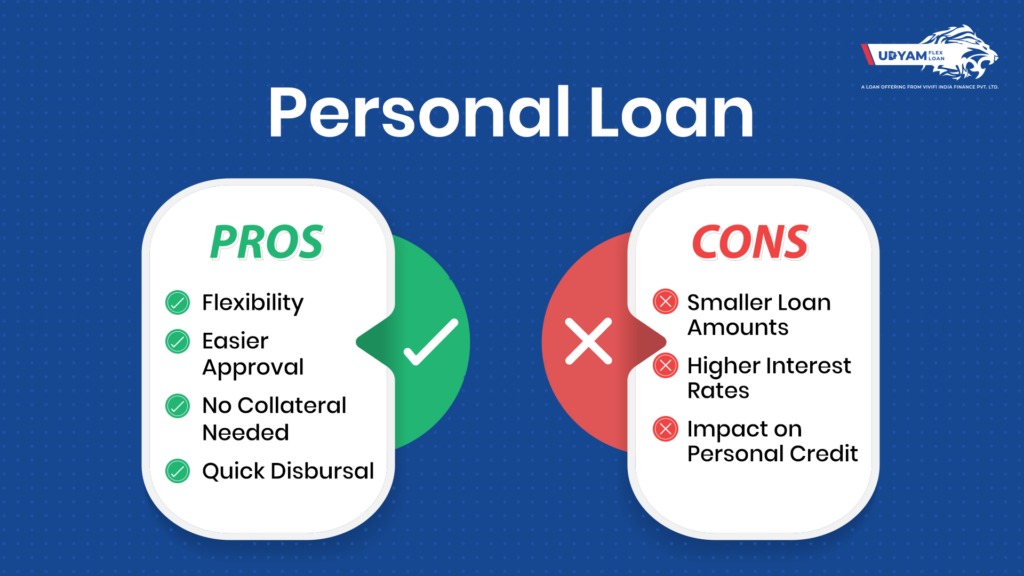

Pros of Personal Loans:

- Flexibility: Can be used for various purposes, including business needs.

- Easier Approval: Typically has less stringent approval criteria than business loans.

- No Collateral Needed: Most personal loans are unsecured, meaning no need to put up assets.

- Quick Disbursal: Personal loans often have faster processing times, providing quick access to funds.

Cons of Personal Loans:

- Smaller Loan Amounts: Usually offer lower amounts compared to business loans.

- Higher Interest Rates: Interest rates are often higher than those of business loans.

- Impact on Personal Credit: Using a personal loan for business can affect your personal credit score.

- No Business Credit Benefit: This does not help in building your business credit profile.

| Feature | Udyam Flex Loan | Traditional Business Loans | Personal Loans |

| Loan Amount | Up to ₹ 10,00,000 | Typically higher limits depend on the lender | Up to ₹50,00,000 |

| Purpose | Small business expansion and management | General business needs, including expansion | Personal expenses, emergencies, or debt consolidation |

| Application Process | Fast, online application with minimal paperwork | Lengthy application with extensive documentation | Quick online or in-person application, less paperwork |

| Disbursal Time | Fast, usually within 24-48 hours | Can take several weeks to a month | Often within a few hours to a few days |

| Flexibility | Highly flexible, adjustable as needed | Fixed amount and terms, less flexibility | Fixed amount and terms, generally less flexible |

| Collateral Requirement | Minimal or unsecured | Often requires significant collateral | Typically unsecured, though some may require collateral |

Which Is Better for Small Business?

The choice between a business loan and a personal loan depends on your specific needs, financial situation, and long-term goals.

When to Choose a Business Loan:

- Established Business: If you have an established business with a good credit history and need a substantial amount of money.

- Specific Business Needs: When the loan is for a specific business purpose, such as buying equipment or expanding operations.

- Building Business Credit: If you aim to build or improve your business credit profile.

When to Choose a Personal Loan:

- Startups: If you are just starting and don’t have a strong business credit profile yet.

- Smaller Amounts: When you need a smaller amount of money quickly.

- Easier Approval: If you need funds quickly and cannot meet the stringent requirements of a business loan.

What is Udyam Flex Loan ?

For those needing quick and flexible funding, Udyam Flex Loan is an excellent option. Udyam Flex Loan offers flexible credit lines and instant loans tailored to small business needs. With loan options ranging from ₹10,000 to ₹10,00,000 and customizable terms, Udyam Flex Loan caters to a wide range of financial requirements.

Why Choose Udyam Flex Loan for Your Small Business?

- Immediate Access to Funds: Udyam Flex Loan offers quick access to funds for urgent business expenses, ensuring you get the support you need without delay.

- No Collateral Required: Udyam Flex Loan offers unsecured loans, meaning you don’t need to pledge any assets, simplifying the approval process.

- Boost Your Credit Score: Timely repayment of your loan can enhance your business credit score, improving your creditworthiness for future loan applications.

- Fast Approval and Disbursal: Udyam Flex Loan ensures rapid approval and fund disbursal, helping you manage urgent financial needs swiftly and efficiently.

- Minimal Documentation: The loan application process is streamlined, requiring minimal documentation, making it faster and easier to complete.

- Tailored Loan Amounts: Whether you need a small or large loan, Udyam Flex Loan provides flexible loan amounts tailored to your specific financial situation, ensuring you get the right amount to meet your needs.

Also read-small business finance made easy with Udyam Flex Loan

Eligibility Criteria for Udyam Flex Loan

To benefit from the Udyam Flex Loan, MSMEs must meet the following eligibility criteria:

- Minimum Business Operational History: 6 months

- Business Registration Proof: Required

- Minimum Monthly Turnover: ₹30,000

How to Apply for Udyam Flex Loan

Applying for a Udyam Flex Loan is straightforward and can be done in three simple steps:

- Download the App: The Udyam Flex Loan app is available in major app stores.

- Fill in Personal & Business Details: Provide the necessary information about yourself and your business.

- Upload Business Documents: Submit the required documents for verification.

Once your verification is complete, you can access the funds instantly, allowing you to use the money to grow your business right away.