Benefits of Business Microloans for Women Entrepreneurs

MSME Loans provide small-scale, accessible financing options tailored to the needs of women entrepreneurs. These loans offer numerous benefits that extend beyond mere financial support. Fostering economic independence, skill development, and community growth are also the key roles these loans are playing. Let’s explore the key advantages that MSME business microloans bring to women entrepreneurs in India.

Business Microloans

These are small-scale financial products designed to support entrepreneurs and small business owners who may not qualify for traditional bank loans. These loans provide accessible funding for startups, inventory purchases, equipment acquisition, or working capital. MSME Business Loans play a crucial role in fostering financial inclusion, particularly for women entrepreneurs and those in rural areas. It is helping to stimulate economic growth at the grassroots level.

Impact of MSME Loans For Women

- Financial inclusion and empowerment: MSME loans for women are providing access to formal credit for female entrepreneurs. For many decades women entrepreneurs were underserved by traditional banking systems. These loans empower women to start and expand businesses, fostering economic independence. By having control over financial resources, women gain decision-making power both in their businesses and households. This financial inclusion is empowering women to challenge societal norms and promote gender equality.

- Skill enhancement and development: Access to small business loans often comes with additional support services. They include financial literacy training, business management workshops, and mentorship programs. These initiatives help women entrepreneurs develop crucial skills in areas such as bookkeeping, marketing, and strategic planning. As they manage their loans and grow their businesses, women gain hands-on experience. It builds their confidence and expertise in entrepreneurship.

- Increased competitiveness in the market: MSME loans enable women-led businesses to invest in technology, equipment, and inventory. This enhances their productivity and product quality. This increased capacity allows them to compete more effectively in local and sometimes even national markets. The financial backing also provides the flexibility to explore new business opportunities and innovate. These loans are helping women entrepreneurs stay relevant in rapidly changing market conditions.

- Contribution to the economic growth of India: Women-led MSMEs supported by these loans contribute significantly to India’s economic growth. They create employment opportunities, particularly for other women, fostering inclusive growth. These businesses often focus on local needs, stimulating regional economic development. As women entrepreneurs succeed, they become role models. It is inspiring more women to enter business, thus creating a positive cycle of economic empowerment and growth that benefits the entire nation.

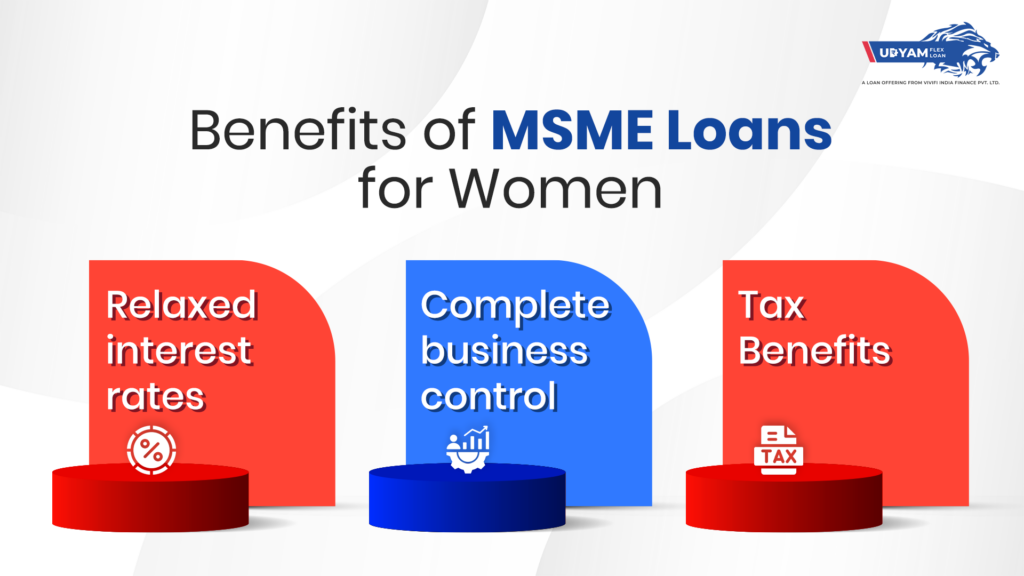

Benefits of MSME Loans for Women

- Relaxed interest rates: MSME loans for women offer more favorable interest rates compared to general business loans. Many financial institutions and government schemes offer lower interest rates specifically for women entrepreneurs. It is done as the institutions are recognizing the need to promote gender equality in business ownership. For instance, some banks provide interest rate concessions of 0.25% to 0.5% for women-owned MSMEs. The Mudra Yojana scheme, which focuses on micro-enterprises, often offers loans to women at rates as low as 8-12% per annum. It is significantly lower than many commercial loans. These relaxed rates reduce the financial burden on women entrepreneurs. It allows them to allocate more resources towards business growth and development rather than loan repayment.

- Complete business control: MSME business loans for women are designed to provide financial support without interference in business operations. Unlike equity financing, where investors may demand a say in business decisions, these loans allow women entrepreneurs to retain complete control over their ventures. This autonomy is crucial for women who often face societal pressures and gender biases in business. The ability to make independent decisions about product development, marketing strategies, and overall business direction empowers women to realize their entrepreneurial vision fully. Moreover, maintaining control helps build confidence and leadership skills, which are essential for long-term business success and personal growth.

- Tax benefits: Women entrepreneurs can enjoy several tax benefits when availing of MSME loans. It makes business ownership financially more attractive. Under Section 80C of the Income Tax Act, the principal amount repaid on MSME loans can be claimed as a deduction, up to a limit of ₹1.5 lakh per financial year. Also, the interest paid on these loans is tax-deductible under Section 36(1)(iii) of the Income Tax Act, reducing the overall tax liability of the business. Some state governments also offer stamp duty concessions for women entrepreneurs registering their businesses. It further reduces the cost of formalization. These tax benefits not only provide immediate financial relief but also encourage women to formalize their businesses, bringing them into the organized sector. This formalization opens up more opportunities for growth, including access to larger loans, government contracts, and export markets.

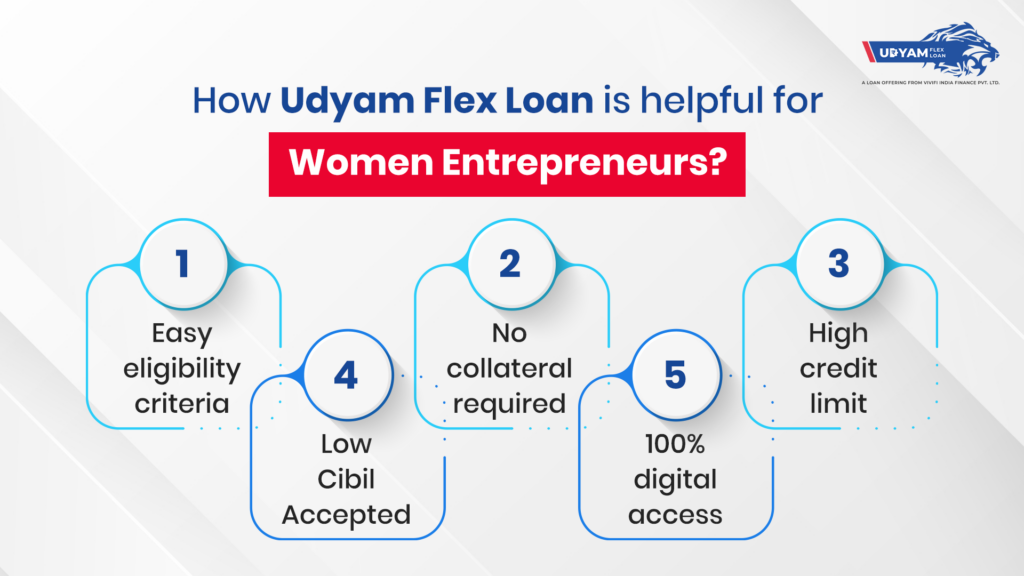

How Udyam Flex Loan is helpful for Women Entrepreneurs

- Easy eligibility criteria: The Udyam Flex Loan simplifies the borrowing process for women entrepreneurs by offering relaxed eligibility criteria. With the MSME registration certificate and monthly turnover of INR 30,000 or above your business is eligible for this loan. Here the loan approval requires minimal documentation. This streamlined approach reduces barriers to entry, especially for first-time entrepreneurs.

- No collateral required: One of the most empowering features of this loan is being collateral-free. Many women entrepreneurs face challenges in providing collateral due to limited asset ownership or societal norms. These things often restrict their property rights. By eliminating the need for collateral, this loan opens up financing opportunities to a broader spectrum of women business owners. It enables them to pursue their entrepreneurial dreams without the burden of risking personal or family assets.

- High credit limit: The Udyam Flex Loan provides higher credit limits for up to ₹10 lakh. This substantial amount allows women entrepreneurs to think bigger and pursue more ambitious business plans. Whether it’s investing in advanced machinery, expanding to new locations, or scaling up production, the higher credit limit provides the financial backing needed for significant growth initiatives.

- Meet multiple requirements: The flexibility of this MSME Business Loan is one of its key strengths. Women entrepreneurs can use the funds for various business purposes, including working capital, equipment purchase, business expansion, or even debt consolidation. This versatility allows business owners to address multiple needs simultaneously or adapt their financial strategy as business requirements evolve. It provides a comprehensive solution for diverse business challenges.

- 100% digital access: The Udyam Flex Loan’s end-to-end online process is a game-changer for women entrepreneurs. From application to disbursement, the entire process can be managed digitally. It saves time and resources. This digital approach is beneficial for women who may have constraints on their mobility or time due to family responsibilities. The online platform also often provides real-time updates on application status and offers customer support. It ensures transparency and ease of communication throughout the loan process.

Breaking societal norms, women are actively launching businesses across various sectors, including kirana stores, IT services, textile and manufacturing, and many more. However, many women struggle to secure funding due to gender biases and lack of collateral. The Udyam Flex Loan aims to reduce the barriers women face in starting and expanding their businesses. This small business loan, ranging from 10,000 to 10,00,000/- is tailored to support small-scale businesses and start-ups with their flexible options.

This quick disbursal MSME Loan offers the perfect solution to all your past challenges like a low credit score, new credit history, small-scale business or lesser turnover etc. It offers equal opportunities and accessible financial support to both men and women entrepreneurs based on their business rather than gender. This inclusive approach helps level the playing field, allowing women entrepreneurs to access funding, grow their businesses, and contribute meaningfully to the economy.

Key takeaways:

- MSME loans are helping bridge the gender gap in business ownership, with women-owned enterprises now accounting for 20% of all MSMEs in India, up from 14% in 2013.

- These loans offer benefits beyond financial support, fostering economic independence, skill development, and community growth for women entrepreneurs.

- MSME loans for women often come with relaxed interest rates, complete business control, and tax benefits, making them more attractive than traditional financing options.

- The Udyam Flex Loan offers easy eligibility criteria, no collateral requirements, high credit limits up to ₹10 lakh, and 100% digital access, addressing many challenges faced by women entrepreneurs.

- These loans enable women-led businesses to invest in technology and equipment, increasing their competitiveness in the market and ability to innovate.

- Women-led MSMEs supported by these loans contribute significantly to India’s economic growth by creating employment opportunities and stimulating regional development.