Banks or NBFC: Which is better for Business Loan?

Are you struggling to choose between a bank loan and an NBFC loan for your business? With over 70% of small businesses relying on external financing, the decision is crucial. In this blog, we’ll explore both options, including how Udyam Flex Loan can offer tailored solutions to meet your business needs.

Bank Loans for Business

Bank loans have long been the traditional route for business financing. They offer a sense of reliability and stability, often with lower interest rates due to their regulated nature. However, these loans come with stringent eligibility criteria and a lengthy approval process.

Advantages of Bank Loans

- Lower Interest Rates Banks typically offer lower interest rates, which can save you money over the life of the loan.

- Higher Loan Amounts If you need a large sum, banks might be able to provide higher loan amounts.

- Established Reputation Banks have been around longer and have built trust over time.

- Longer Repayment Terms Banks often offer longer repayment periods, which can mean lower monthly payments.

- Additional Services You might get access to other banking services and build a long-term relationship.

NBFC Business Loans

NBFCs have emerged as a viable alternative to banks, offering a more flexible and accessible approach to business financing. They are especially popular for unsecured business loans, catering to businesses that may not meet the stringent criteria set by banks.

Advantages of NBFC Loans

- Faster Processing NBFCs are known for quick loan approvals and disbursals, sometimes within 24 hours.

- Flexible Eligibility Criteria They often have more relaxed requirements, making it easier for smaller or newer businesses to qualify.

- Less Documentation You’ll typically need to submit fewer documents compared to bank loans.

- Unsecured Loan Options Many NBFCs offer unsecured business loans, which don’t require collateral.

- Customized Solutions NBFCs often provide more tailored loan products to suit specific business needs.

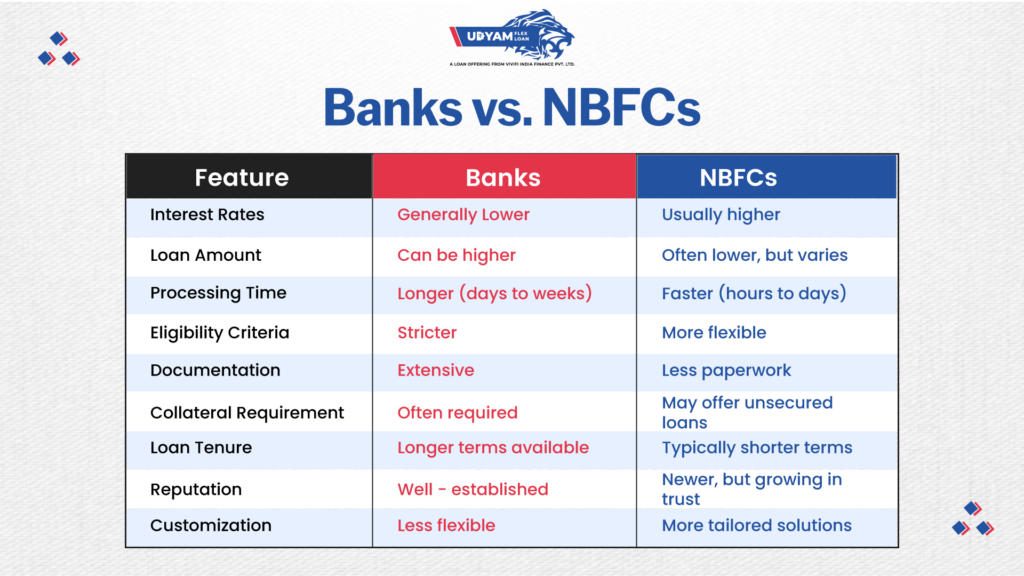

Banks vs. NBFCs for Business Loans

| Feature | Banks | NBFCs |

| Interest Rates | Generally lower | Usually higher |

| Loan Amount | Can be higher | Often lower, but varies |

| Processing Time | Longer (days to weeks) | Faster (hours to days) |

| Eligibility Criteria | Stricter | More flexible |

| Documentation | Extensive | Less paperwork |

| Collateral Requirement | Often required | May offer unsecured loans |

| Loan Tenure | Longer terms available | Typically shorter terms |

| Reputation | Well-established | Newer, but growing in trust |

| Customization | Less flexible | More tailored solutions |

Which Should You Choose?

The best option depends on your specific situation. Consider these factors:

- How Much Do You Need? For larger amounts, banks might be better. For smaller, quick loans, NBFCs could be ideal.

- How Soon Do You Need It? If time is of the essence, NBFCs generally process loans faster.

- What’s Your Credit Score? If you have a strong credit history, you might get better terms with a bank. If your credit isn’t perfect, an NBFC might be more accommodating.

- Do You Have Collateral? If you’re willing and able to provide collateral, you might get better terms with a bank. For unsecured loans, NBFCs often have more options.

- How Established Is Your Business? Newer businesses might find it easier to qualify with NBFCs, while more established ones might benefit from bank relationships.

Udyam Flex Loan: A Smart Choice for Small Businesses

Among the various NBFC options, the Udyam Flex Loan by Vivifi India NBFC stands out. It offers up to ₹10,00,000 with a quick and straightforward application process. Designed specifically for small businesses, the Udyam Flex Loan provides highly flexible loan amounts and terms.

This ensures that businesses can manage their finances efficiently without the lengthy procedures associated with traditional banks.

Features of Udyam Flex Loan

Easy Access to Funds

- Loan Amount: Obtain loans up to ₹10 lakhs, providing substantial financial support without the complex procedures typical of traditional loans.

- Fast Disbursal: Funds are disbursed quickly after the verification process, allowing businesses to access the capital they need without delay.

Low Credit Score Accepted

- Credit Score Flexibility: Even with a credit score of 500+, you can qualify for a loan. This feature makes the Udyam Flex Loan accessible to a wider. range of entrepreneurs who might struggle to secure funding from traditional lenders.

No Collateral Needed

- Unsecured Loan: The Udyam Flex Loan does not require any collateral, reducing the risk for borrowers and making it easier for businesses to obtain funding.

Flexible Tenure and Interest Rates

- Tenure Options: Choose a repayment period that suits your business needs, with tenures ranging from 6 to 18 months.

- Interest Rates: Competitive interest rates range from 18% to 48%, allowing businesses to manage their repayment schedules effectively.

Minimal Documentation Required

- Simplified Requirements: The documentation needed for the loan application is minimal, including basic personal and business documents such as identity proof, address proof, business registration proof, and recent bank statements.

Eligibility Criteria for Udyam Flex Loan

To benefit from the Udyam Flex Loan, MSMEs must meet the following eligibility criteria:

- Minimum Business Operational History: 6 months

- Business Registration Proof: Required

- Minimum Monthly Turnover: ₹30,000

Read more about- MSME Business Loan

How to Apply for Udyam Flex Loan

Applying for a Udyam Flex Loan is straightforward and can be done in three simple steps:

- Download the App: The Udyam Flex Loan app is available in major app stores.

- Fill in Personal & Business Details: Provide the necessary information about yourself and your business.

- Upload Business Documents: Submit the required documents for verification.