MSME Registration in India: Exploring Benefits, Challenges, and Key Insights

Table of Contents

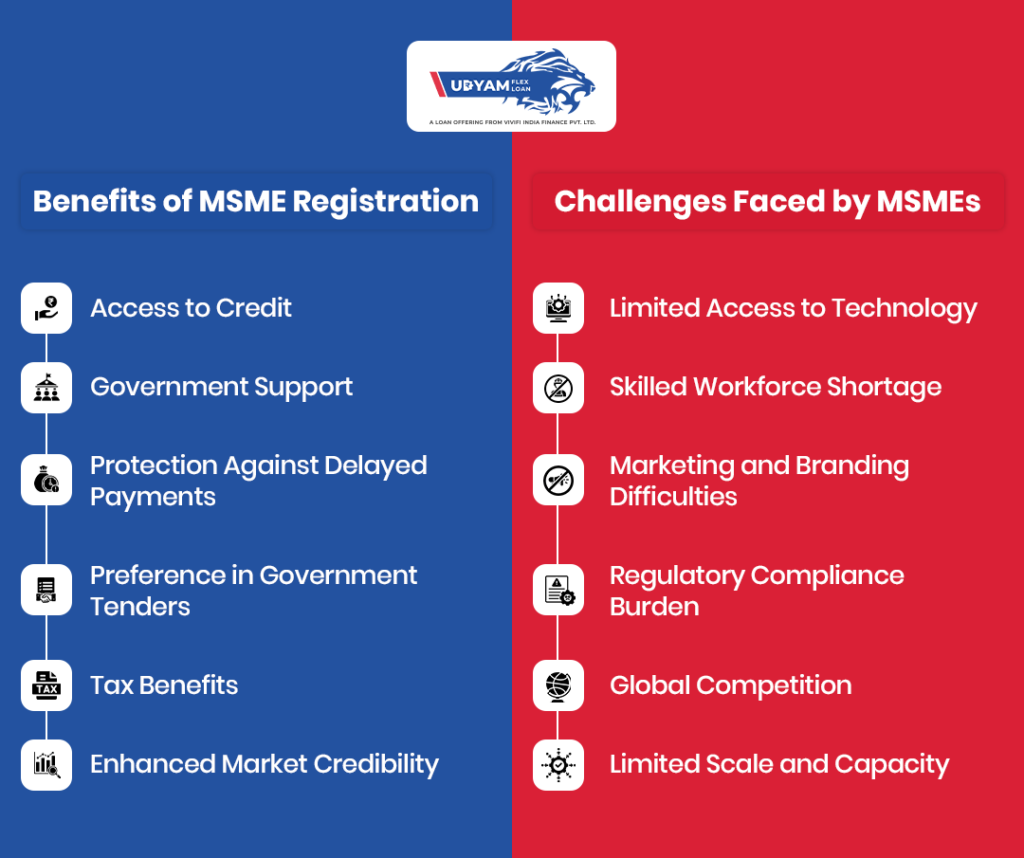

Did you know that MSMEs contribute nearly 30% to India’s GDP and employ over 110 million people? Micro, Small, and Medium Enterprises (MSMEs) are the backbone of India’s economy, driving growth and innovation. While registering as an MSME offers several benefits like easier access to credit and government support, these enterprises also face challenges such as limited technology adoption and global competition. In this blog, we’ll dive into both the advantages of MSME registration and the challenges that come with running a small business in India. We shall also look into how Udyam Flex Loan can help MSMEs grow.

Top 6 Benefits of MSME Registration in India

Here’s a handy list:

- Access to Credit

- Government Support

- Protection Against Delayed Payments

- Preference in Government Tenders

- Tax Benefits

- Enhanced Market Credibility

What are the Benefits of MSME Registration?

- Access to Credit

- Government Support

- Subsidies on patent registration: Encourages innovation and protects intellectual property.

- Industrial promotion subsidies: Financial incentives to stimulate industrial growth.

- Reimbursement of ISO certification charges: Helps MSMEs achieve quality standards.

- Capital investment subsidies: Reduces the financial strain when investing in infrastructure or technology.

- Protection Against Delayed Payments

- Preference in Government Tenders

- Tax Benefits

- Enhanced Market Credibility

One of the most notable benefits of MSME registration is improved access to credit. Registered MSMEs have the advantage of availing loans at lower interest rates from banks and financial institutions. The government has introduced several schemes aimed specifically at helping MSMEs secure funding, which eases the financial burden and fosters business growth. For instance, the MUDRA scheme allows MSMEs to borrow funds without stringent collateral requirements.

MSMEs registered with the government can access various support programs. These include:

Under the MSME Development Act, registered MSMEs are entitled to protection against delayed payments from buyers. The act mandates timely payments and includes provisions for interest on overdue payments. This legal protection empowers small businesses, ensuring they receive payment for their goods and services on time.

Registered MSMEs enjoy preferential treatment in government procurement. Some tenders are exclusively reserved for MSMEs, providing them a better chance of securing contracts. This preference helps smaller businesses gain visibility and contribute to larger projects, ultimately boosting their growth.

Get Udyam Flex Loan! Get Your Business ka Booster!

MSMEs can take advantage of various tax incentives. For instance, certain categories of MSMEs benefit from lower rates of Goods and Services Tax (GST). These tax benefits ease the financial burden on small enterprises and enhance their competitiveness.

MSME registration boosts a business’s reputation, fostering trust with suppliers, customers, and investors. It encourages better supplier terms, builds customer confidence, and offers an edge in tenders and partnerships, positioning the business as a reliable and competitive entity.

What are the Key Challenges of MSMEs in India

- Limited Access to Technology

- Skilled Workforce Shortage

- Marketing and Branding Difficulties

- Regulatory Compliance Burden

- Global Competition

- Limited Scale and Capacity

Many MSMEs face challenges in adopting modern technologies. Financial constraints and lack of awareness often hinder their ability to invest in advanced technology, putting them at a competitive disadvantage compared to larger enterprises.

Finding and retaining a skilled workforce is a significant challenge for MSMEs, especially in rural and semi-urban areas. The lack of training facilities and educational institutions further complicates this issue, leading to a shortage of qualified candidates.

MSMEs often lack the marketing and branding resources that larger companies possess. This limitation makes it challenging for them to create brand awareness and attract customers, particularly in highly competitive markets. Without effective marketing strategies, MSMEs may struggle to establish their presence.

While MSME registration brings benefits, it also entails increased regulatory compliance. Small businesses often find it challenging to meet the myriad regulations due to limited resources. This compliance burden can divert attention from core business activities, hindering growth.

The advent of globalization has intensified competition for MSMEs. They often find it challenging to compete with international players who can offer better quality and pricing due to economies of scale. As markets become more interconnected, MSMEs must innovate and adapt to survive.

Many MSMEs face constraints that limit their ability to scale up operations. Financial limitations, combined with a lack of access to resources, can hinder their growth potential. Without the ability to expand, these enterprises may struggle to achieve long-term sustainability.

How Can Udyam Flex Loan Empower MSMEs for Growth?

Udyam Flex Loan, from Vivifi India Finance Pvt. Ltd offers MSMEs loans up to ₹10 lakhs, designed to cater to their immediate capital requirements. With flexible terms and competitive interest rates Udyam Flex Loans provides MSMEs smooth cash flow and operational efficiency.

Key Benefits of Udyam Flex Loan

- Fast Access to Funds: Avail up to ₹10 lakhs with ease, avoiding the hassles of traditional lending processes.

- Less-than-Ideal Credit Score Friendly: Even with a less-than-ideal credit score, MSMEs can qualify, making it accessible to a broader audience.

- Fully Digital Process: The entire loan application is done online, providing speed and convenience.

- No Collateral Needed: No requirement for collateral reduces the risk for MSMEs.

- Excellent Customer Support: Experience dedicated support throughout the loan process with a dedicated customer support team.

Parting Thoughts

MSME registration in India offers key benefits like easier access to credit and government support, but challenges such as technology gaps and global competition remain.

With the right support, MSMEs can drive economic growth, create jobs, and boost competitiveness, contributing significantly to India’s future success.Consider Udyam Flex Loan from Vivifi India Finance Pvt. Ltd as your business ka booster, providing flexible funding options to help you grow and manage your enterprise effectively.