Mudra Loan for Women

Around 20% of enterprises in India are women-owned, yet female entrepreneurs face challenges like limited access to finance and gender biases. Mudra Loans for Women Entrepreneurs empower them by providing essential financial resources and fostering a supportive environment, helping them balance domestic and business demands and improve market opportunities and technological literacy.The best part? You don’t need to run from pillar to post to apply. Apply online through the udyamimitra.in the portal. You can also approach various banks, small finance banks, or even NBFCs for this loan. It’s super flexible!Here’s a pro tip: determine which category your business falls into before applying. It’ll help you understand your funding needs better and plan for future growth.

PMMY has been a blessing for non-corporate, non-farm micro-enterprises. It’s not just about the money; it’s also about the boost of confidence it gives you as an entrepreneur. Knowing that there’s a government scheme that believes in your small dream as much as you do – that’s priceless!

So, if you’re sitting on a brilliant business idea but worrying about funds, give PMMY a shot. Who knows? This could be the launch pad for your entrepreneurial journey!

Remember, every big business started small with schemes like PMMY.

Mudra Loan For Women

In the landscape of Indian entrepreneurship, a silent revolution has occurred since 2015. The Micro-Units Development and Refinance Agency (MUDRA) loans, introduced under the visionary Pradhan Mantri Mudra Yojana (PMMY), have been quietly transforming the lives of millions of aspiring business owners.

Imagine a financial ecosystem where the size of your venture doesn’t constrain your dreams. That’s exactly what MUDRA loans bring to the table. With their innovative three-tier system – Shishu, Kishor, and Tarun – these loans cater to businesses at every growth stage, from fledgling startups to expanding enterprises.

As these micro and small enterprises flourish, they’re not just achieving personal success. They’re becoming the backbone of our economy, driving growth from the grassroots. More importantly, they’re challenging societal norms and paving the way for a more equitable business landscape.

Mudra Mission and Vision

To be a world-class financial and support services provider for the underserved. It aims to foster comprehensive economic and social development by adhering to global best practices.

Its mission is to offer tailored solutions that empower businesses at the bottom of the pyramid to achieve their full potential. Collaborating with partner institutions to foster an inclusive, sustainable, and value-driven entrepreneurial culture that achieves economic success and financial security.

Categories of Mudra Loan for Women

- Shishu Category: Mudra Yojana for women supports micro-businesses with loans up to Rs. 50,000, providing initial financial aid to help small and budding entrepreneurs launch their ventures.

- Kishor Category: Mudra loans for women entrepreneurs offer Rs. 50,001 to Rs. 5,00,000 to enhance and expand moderate-scale businesses, providing substantial support for sustainable growth.

- Tarun Category: Pradhan Mantri loans for women provide significant financial assistance from Rs. 5,00,001 to Rs. 10,00,000, aimed at substantial business development and expansion plans.

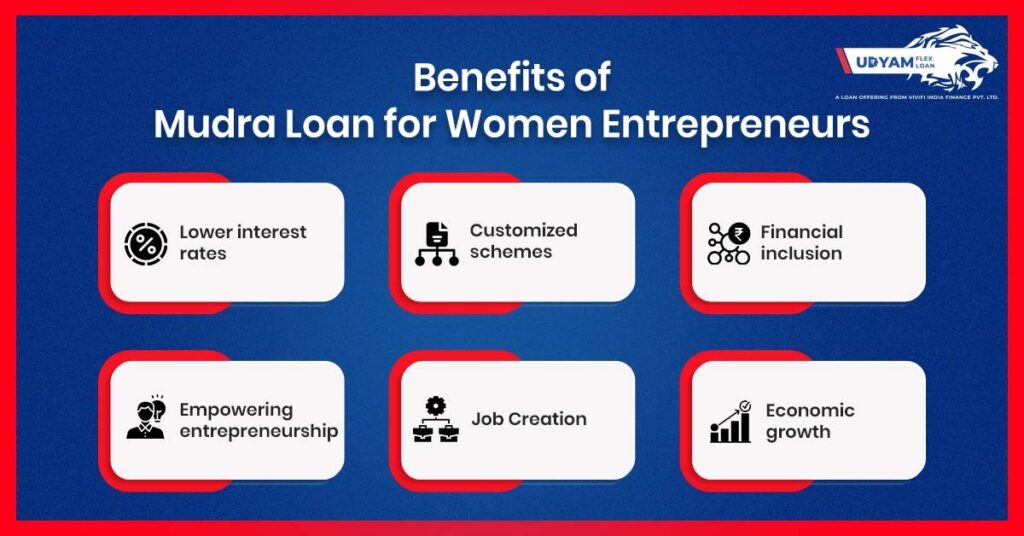

Benefits of Mudra Loan for Women Entrepreneurs

Beyond traditional financial assistance, Mudra Loans for women offer competitive interest rates and diverse categories. It is challenging gender norms and fostering economic growth. Open to both individuals and legal entities, these loans encourage widespread entrepreneurship. Pradhan Mantri Mudra Loans empower women by defying societal norms, promoting socio-economic advancement, and equipping them for innovative entrepreneurship.

- Lower interest rates: Mudra loans for women entrepreneurs offer affordable borrowing with reduced interest rates. It promotes business growth and uses financial burdens.

- Customized schemes: Pradhan Mantri Mudra loan provides flexible, personalized financial solutions to the unique needs of women entrepreneurs. It is fostering diverse business ventures.

- Financial inclusion: Mudra loan Yojana bridges the gender gap in entrepreneurship. It is empowering women to participate in economic activities and significantly contributing to India’s economic development.

- Empowering entrepreneurship: Prime Minister loans for women provide easy access to capital. It encourages the exploration of diverse business opportunities. It is also fostering innovation while enhancing the sector’s diversity.

- Job creation: These loans for women, and entrepreneurs boost local employment. It plays a crucial role in job creation and strengthening the community’s economic fabric.

- Economic growth: Mudra loans empower women by unlocking the potential of India’s female workforce. It is transforming them into key players in economic development and driving social progress.

MUDRA Loan for Women Entrepreneurship isn’t just about money; it’s about fostering a spirit of entrepreneurship. It’s about believing in the power of small ideas to make big changes. For women entrepreneurs, in particular, the Ladies MUDRA loan has been nothing short of a game-changer. It’s not merely providing financial assistance; it’s fueling ambitions, breaking barriers, and reshaping the narrative of women in business.

In essence, MUDRA loans are more than a financial scheme; they’re a testament to the power of inclusive growth. They remind us that in the business world, size doesn’t matter – the size of your dream counts.

To encourage the spirit of women entrepreneurship and take ahead the mission of Mudra loan, Udyam Flex Loan is playing a key role. Serving as the “Business ka Booster”, this loan is empowering MSMEs to make their Small businesses go BIG! Your business is eligible for this loan with an operational history of 6 months. By providing the MSME/Udyam registration and showing the minimum monthly turnover of INR 30,000, your business can qualify for the Mudra Loan for Women Eligibility criteria here. Besides being easy to avail of, the Udyam Flex Loan is a one-for-all credit solution for your business.

Secure this collateral-free loan to manage the day-to-day expenses of your business. It works perfectly as the working capital for your business. Whether to use it for equipment, financing and or as growth capital, The Udyam Flex Loan can be an apt, business ka booster for businesses belonging to any industry.