Benefits of taking Udyam Registration

Have you ever wondered how small businesses secure the recognition and support they need to thrive? Udyam Registration empowers Micro, Small, and Medium Enterprises (MSMEs) in India. This straightforward online process grants official recognition and makes businesses eligible for various government schemes and benefits, significantly boosting access to resources and financial support.In this blog, we’ll explore the Udyam Business Loan, its hassle-free financial solutions for MSMEs, and the key advantages of Udyam Registration.

What is Udyam Registration?

Udyam Registration is a simple online process where small businesses, known as Micro, Small, and Medium Enterprises (MSMEs), can register with the Ministry of MSME. This registration gives businesses an official recognition and makes them eligible for various government schemes and benefits.

Udyam Registration: Key Benefits of Business Loans for MSMEs

-

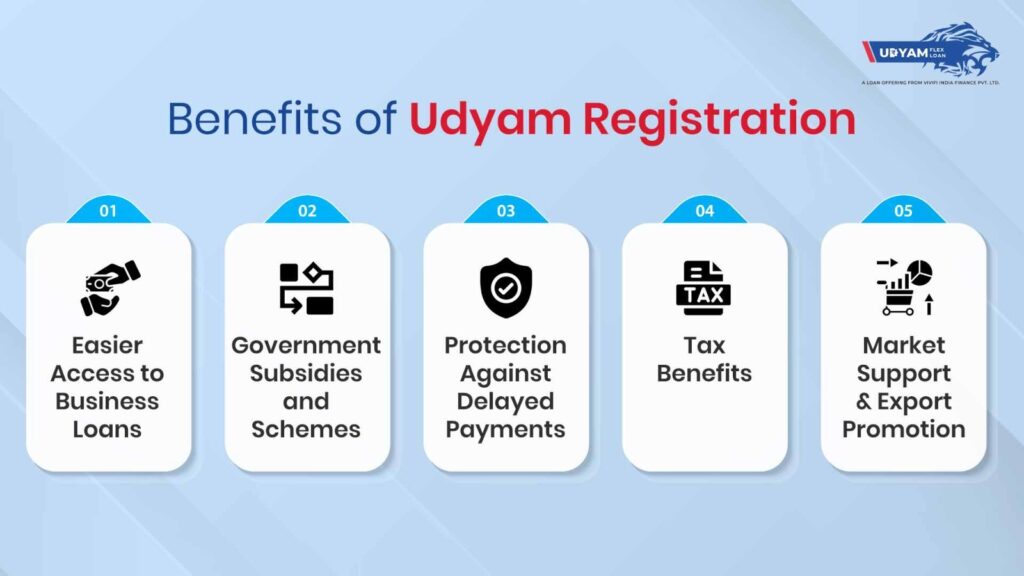

Easier Access to Business LoansOne of the biggest challenges small businesses face is securing loans. With Udyam Registration, businesses can enjoy several advantages that make accessing loans easier:

- Collateral-Free Loans: Registered MSMEs can avail of collateral-free loans under various government schemes. This means you don’t need to provide any assets as security to get the loan, which is a significant relief for many small business owners.

- Lower Interest Rates: Banks and financial institutions offer lower interest rates to Udyam-registered businesses. This reduces the cost of borrowing and makes it easier to manage repayments, thereby supporting business growth and stability.

- Priority Lending: Udyam-registered businesses are given priority by banks under the Priority Sector Lending guidelines. This ensures that a certain portion of bank lending is reserved for MSMEs, increasing the likelihood of loan approval.

-

Government Subsidies and Schemes

- Subsidies on Patent Registration: Businesses with Udyam Registration can avail themselves of subsidies on patent and trademark registration. This encourages innovation and helps protect your business’s intellectual property without a heavy financial burden.

- Industrial Promotion Subsidies: Various state governments provide subsidies for industrial promotion to Udyam-registered businesses. These subsidies can significantly reduce operational costs and support business expansion.

-

Protection Against Delayed Payments

- Fast-Tracked Payment Resolution: Udyam-registered businesses are protected under the MSMED Act, which mandates that buyers must make payments within a specified period. In case of delays, MSMEs can charge compound interest on the amount due, ensuring a smoother cash flow.

- Dispute Resolution: VIn case of payment disputes, Udyam-registered businesses can seek help from the Micro and Small Enterprise Facilitation Council (MSEFC) for quick resolution. This helps in maintaining business stability and financial health.

-

Tax Benefits

- Direct Tax Exemptions: MSMEs with Udyam Registration can benefit from various direct tax exemptions and rebates, which help in reducing the overall tax burden on the business.

- Easier Compliance with GST: The government provides simplified GST compliance procedures for Udyam-registered businesses, making it easier to file returns and manage tax obligations.

-

Market Support and Export Promotion

- Participation in Trade Fairs: Udyam-registered businesses get special consideration for participation in international trade fairs, exhibitions, and buyer-seller meets. This helps in expanding market reach and exploring new business opportunities.

- Export Subsidies: he government offers various subsidies and incentives to promote exports by MSMEs. Udyam Registration makes it easier to access these benefits and expand your business globally.

How to Register for Udyam

The registration process for Udyam is straightforward and can be done online. Here are the basic steps:

- Visit the Udyam Registration Portal: Start by visiting the official Udyam Registration website.

- Fill in the Required Details: Provide essential information about your business, such as the Aadhaar number, business name, address, and other relevant details.

- Submit the Form: Once the form is filled, submit it online. There is no registration fee, making it accessible for all small business owners.

- Receive Registration Number: After successful submission, you will receive a unique Udyam Registration Number (URN) and an e-certificate.

Udyam Registration opens up access to numerous government benefits and makes it easier for MSMEs to get business loans. One such loan is the Udyam Flex Loan, offering flexible and hassle-free funding. With Udyam Registration, your business can take full advantage of the Udyam Flex Loan to support growth and expansion.

What is Udyam Flex Loan?

The Udyam Flex Loan, offered by Vivifi India Finance Pvt. Ltd., is designed to empower Micro, Small, and Medium Enterprises (MSMEs) across various sectors. This loan product aims to provide hassle-free financial support to businesses in industries such as manufacturing, services, retail, construction, and healthcare. The Udyam Flex Loan offers flexible funding solutions to help MSMEs manage their working capital needs, invest in equipment, and support business growth.

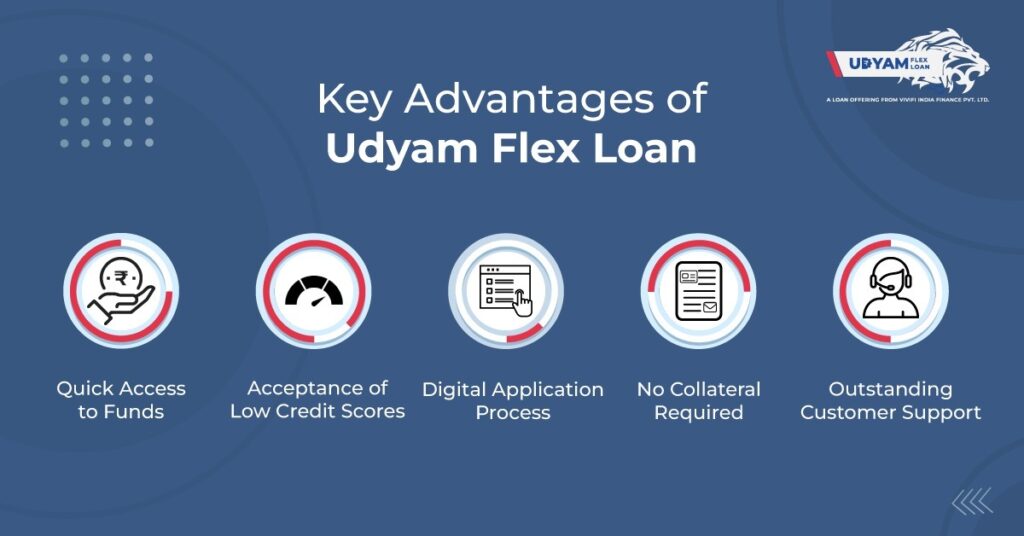

Features of Udyam Flex Loan

- Easy Access to Funds

- Loan Amount: Secure loans up to ₹10 lakhs, providing substantial financial support.

- Fast Disbursal: Quick fund disbursal after verification, ensuring timely access to capital.

- Low Credit Score Accepted

- Credit Score Flexibility: Qualify for a loan with a credit score of 500+, making it accessible to more entrepreneurs.

- Fully Digital Application

- Online Process: The application is entirely online, eliminating lengthy paperwork and ensuring convenience.

- No Collateral Needed

- Unsecured Loan: Obtain funding without the need for collateral, reducing borrower risk.

- Flexible Tenure and Interest Rates

- Tenure Options: Choose repayment periods from 6 to 18 months.

- Interest Rates: Competitive rates ranging from 18% to 48%, enabling effective repayment management.

Eligibility Criteria for Udyam Flex Loan

To benefit from the Udyam Flex Loan, MSMEs must meet the following eligibility criteria:

- Minimum Business Operational History: 6 months

- Business Registration Proof: Required

- Minimum Monthly Turnover: ₹30,000

How to Apply for Udyam Flex Loan

Applying for a Udyam Flex Loan is straightforward and can be done in three simple steps:

- Download the App: The Udyam Flex Loan app is available in major app stores.

- Fill in Personal & Business Details: Provide the necessary information about yourself and your business.

- Upload Business Documents: Submit the required documents for verification.

Once your verification is complete, you can access the funds instantly, allowing you to use the money to grow your business right away.