How To Check Download ITR Filing Status?

Filing your Income Tax Return (ITR) is a key financial responsibility for both individuals and businesses. It’s more than just following the law – it’s about being transparent with your finances and showing you’re a responsible taxpayer. So, why is ITR filing so important, and how can you check and download your filing status?

Income Tax Return (ITR) filing is a fundamental aspect of personal finance management and compliance for individuals and entities in many countries. An Income Tax Return is a form through which taxpayers report their annual income, expenses, deductions, and investments to the tax authorities.

This guide will explain why ITR filing matters, how to download ITR filing status online, and how to check your ITR filing status online. We’ll also touch on the Udyam Flex Loan, which can help small businesses access funds and consider your ITR history in the application process. By staying on top of your tax filings, you can avoid problems, get refunds faster, and build a solid financial record.

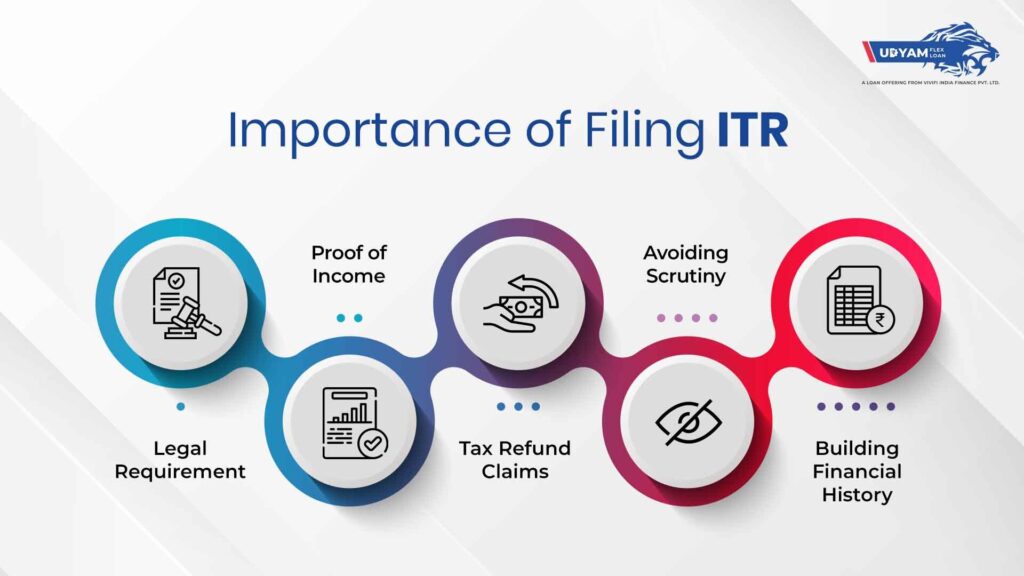

Importance of Filing ITR

Filing an ITR is crucial for several reasons:

- Legal Requirement:

- Mandatory for individuals and entities whose income exceeds the threshold limit set by the government.

- Non-compliance can lead to penalties and legal repercussions.

- Proof of Income:

- Serves as documented proof of income, essential for financial transactions such as applying for loans, credit cards, and visas.

- Tax Refund Claims:

- Enables taxpayers to claim refunds on excess tax paid or deducted.

- Avoiding Scrutiny:

- Ensures you remain in the good books of tax authorities, thereby avoiding any scrutiny or audits.

- Building Financial History:

- Consistent ITR filing helps in building a strong financial history, beneficial for future financial planning and stability.

How to File ITR

Filing ITR has become a straightforward process, especially with the advent of online platforms. Here’s a general overview of the steps involved:

- Gather Necessary Documents:

- Before starting the ITR filing process, ensure you have all required documents such as a PAN card, Aadhaar card, Form 16 (if you are salaried), bank statements, investment proofs, and details of other income sources.

- Choose the Correct ITR Form:

- The income tax department provides different forms for different types of taxpayers. Select the appropriate form based on your income source and category (individual, HUF, company, etc.).

- Login to the Income Tax e-Filing Portal:

- Visit the official Income Tax e-Filing website and log in using your credentials.

- Fill in the Form:

- Enter the required details such as personal information, income details, deductions, and tax paid. Double-check the information to ensure accuracy.

- Verify and Submit:

- After filling in all the details, review the form, calculate your tax liability or refund, and submit the form. Upon submission, you will receive an acknowledgment.

- E-Verify the Return:

- E-verification is mandatory to complete the filing process. This can be done through various methods such as Aadhaar OTP, net banking, or by sending a signed physical copy of ITR-V to the CPC office.

Checking and Downloading ITR Filing Status

Once you have filed your ITR, it is important to track its status to ensure it has been processed correctly. Here’s how you can do it:

- Login to the e-Filing Portal:

- Visit the Income Tax e-Filing website and log in using your PAN number and password to get your e-filing ITR status.

- View Filed Returns:

- Navigate to the ‘e-File’ menu and select ‘Income Tax Returns’ followed by ‘View Filed Returns’. Here, you will find a list of all your filed returns.

- Check Status:

- Select the relevant assessment year to view the status of your return. The status will indicate whether the return is ‘Processed’, ‘Pending for e-verification’, or ‘Defective’.

- Download ITR-V:

- If needed, you can download the ITR-V acknowledgment form from the same section. This document serves as proof of your ITR filing and can be downloaded by clicking on the ‘Download’ button next to the relevant assessment year.

By understanding and following these processes, you can ensure timely compliance with tax regulations, avoid penalties, and secure financial documentation necessary for various future transactions.

Udyam Flex Loan: Empowering MSMEs with Hassle-Free Financing and Smart Tax Management

Udyam Flex Loan, offered by Vivifi India Finance Pvt. Ltd supports MSME entrepreneurs across various industries with hassle-free loans up to ₹10 lakhs. Interest rates range from 18% to 48%, with tenures of 6 to 18 months. The loan application process takes into account your Income Tax Return (ITR) filing status, benefiting businesses with consistent tax filing histories.

Timely management of finances, including filing and monitoring your ITR status, is crucial for MSME owners. This practice can ensure processed returns and timely refunds, providing additional liquidity to manage loan repayments and maintain healthy cash flow. By staying on top of your ITR filings, you can potentially qualify for better loan terms and strengthen your overall financial position.

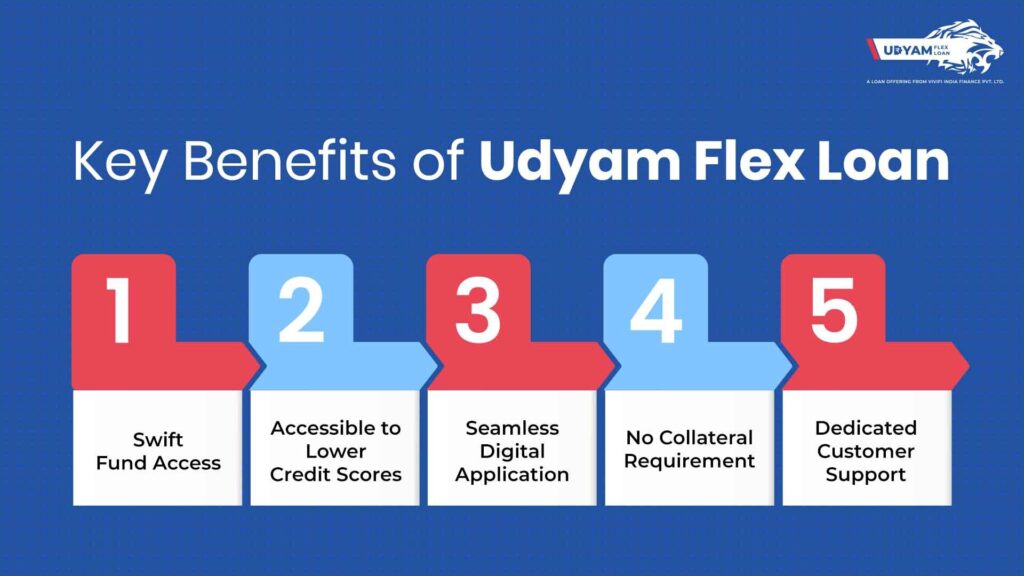

Key Benefits of Udyam Flex Loan

- Swift Fund Access: Obtain loans up to ₹10 lakhs swiftly, bypassing the complexities of traditional loan processes.

- Accessible to Lower Credit Scores: Qualify for a loan even with a lower credit score, enhancing accessibility for small business owners.

- Seamless Digital Application: Enjoy a streamlined online application process for convenience and speed.

- No Collateral Requirement: Avail loans without pledging collateral, reducing risk exposure.

- Dedicated Customer Support: Receive excellent customer service throughout the loan tenure with Udyam Flex Loan.

- Business operational for a minimum of 6 months

- Proof of business registration

- Minimum monthly turnover of ₹30,000

How to Apply for Udyam Flex Loan

Applying for Udyam Flex Loan is straightforward:

- Download the Udyam Flex Loan app from your preferred app store.

- Provide Personal & Business Details: Fill in necessary information including name, address, business type, and MSME/Udyam Registration number.

- Upload Business Documents: Submit required documents such as Aadhaar or PAN, bank statements, and ITR returns.

Upon verification and completing VKYC (Video Know Your Customer), you’ll receive a loan offer. Upon approval, access funds instantly to support your business expansion.