3 Ways Quick Loans up to 10 Lakh Rupees Can Transform Your Business

Table of Contents:

How can a quick ₹10 lakh loan transform your business? Have you ever wondered how fast access to funds could solve cash flow issues or enable growth? With nearly 60% of small and medium enterprises in India facing financial challenges, an instant business loan of up to ₹10 lakh can be a powerful tool. Whether you’re expanding operations, purchasing new equipment, or managing daily expenses, this loan can provide the boost your business needs. In this blog, we’ll explore three impactful ways a ₹10 lakh loan can support and enhance your business growth.

Quick Loans up to Rs. 10 Lakhs Can be a Business Booster

Here’s what can you do with it:

- Fuel Business Expansion Efforts

- Manage Working Capital Needs

- Upgrade Equipment and Technology

How Can Quick Loans Up to Rupees 10 Lakhs Transform Your Business?

- Fuel Business Expansion Efforts

- Infrastructure: You may need to rent new office space, upgrade facilities, or open a new branch. A personal loan of Rs. 10 lakhs provides the necessary capital to cover these costs without draining your savings.

- Hiring New Staff: As your business grows, you’ll likely need more employees. A loan helps you bring in the talent needed to manage increased workload and expand your customer base.

- Marketing & Promotion: Expanding into new markets requires a solid marketing strategy. With a quick business loan, you can invest in advertising, social media campaigns, and promotional activities to build brand awareness.

- Manage Working Capital Needs

- Paying Suppliers on Time: Late payments can strain relationships with suppliers. Applying for a business loan ensures you can pay them on time, maintaining a reliable supply chain.

- Managing Seasonal Fluctuations: If your business experiences seasonal changes in demand, getting a 10 lakh quick business loan can help you stock up on inventory and prepare for busy periods without affecting cash flow.

- Handling Unexpected Expenses: A loan acts as a safety net when unexpected expenses arise, such as equipment repairs or market shifts. This ensures that your operations aren’t disrupted.

- Upgrade Equipment and Technology

- Investing in Machinery: For manufacturing or production-based businesses, upgrading outdated machinery can significantly boost productivity and reduce downtime.

- Upgrading Technology: Whether it’s new software, better servers, or customer service tools, technology upgrades can help streamline operations and improve customer satisfaction.

- Staying Ahead of Competitors: Investing in the latest tools and equipment keeps you ahead of competitors, allowing you to offer better products or services.

Expanding your business often requires significant upfront investment, and not having enough capital can hold you back. With a quick loan of up to ₹10 lakh, you can get the funds needed to grow without disrupting your daily operations.

How a ₹10 Lakh Loan Helps:

Pro Tip: When planning expansion, focus on areas where you see the most growth potential and allocate your funds wisely.

Boost Your Business, Get Loans Up to 10 Lakhs.Download Udyam Flex Loan!

Maintaining smooth day-to-day operations is crucial for any business. Whether it’s covering payroll, paying suppliers, or managing inventory, a quick loan ensures you have the working capital needed to keep things running smoothly.

Pro Tip: Treat the loan as a backup for essential operational costs, and avoid using it for unnecessary expenses.

Staying competitive in the market often requires investing in new technology and equipment. Getting a quick business loan of up to ₹10 lakh can help you make these necessary upgrades to improve productivity and efficiency.

Pro Tip: Focus on upgrades that will provide immediate returns, such as improved efficiency or higher product quality.

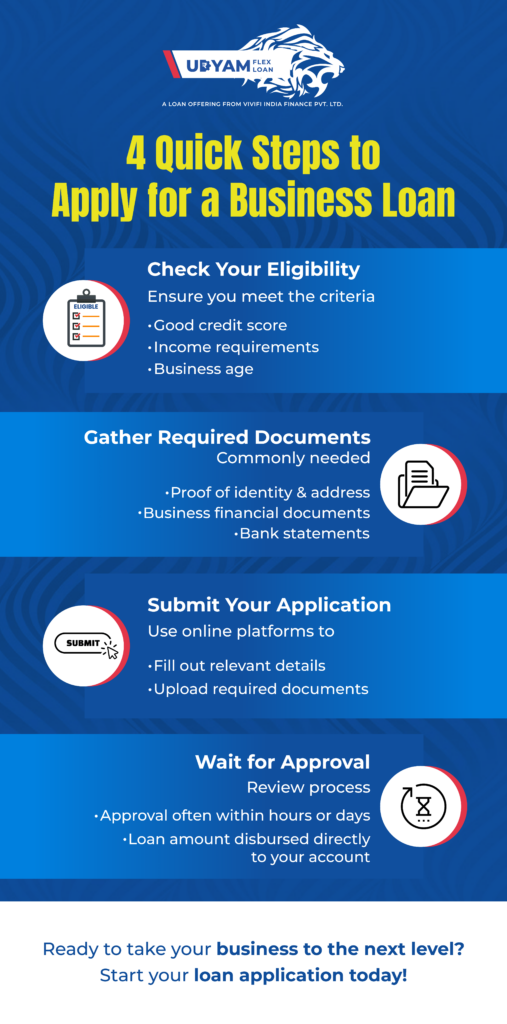

How to Apply for a ₹10 Lakh Quick Business Loan

Applying for a quick business loan has never been easier. Many loan providers now offer online applications with quick approvals, sometimes within hours.

Here’s an infographic that walks you through the simple steps to apply for a business loan.

Pro Tip: Compare interest rates and repayment terms from different loan providers before applying to ensure you get the best deal.

Pro Tip: Compare interest rates and repayment terms from different loan providers before applying to ensure you get the best deal.

Udyam Flex Loan: A Smart Choice for MSME Financing

If you’re seeking a quick business loan, consider Udyam Flex Loan from Vivifi India Finance Pvt. Ltd. With up to ₹10 lakhs quick loan disbursal and flexible repayment terms, it provides a convenient solution for MSMEs.

Why Opt for Udyam Flex Loan?

- Easy Access: Available for borrowers with not so high credit scores.

- Online Application: The application process is fully online, making it fast and convenient.

- No Collateral Required: No need to pledge assets or property to get a business loan.

- Excellent Support: Benefit from outstanding customer service throughout the process.

- Flexible Usage: Use the funds for various business purposes, including expansion and daily operations.

To Sum Up

A quick business loan of up to ₹10 lakh can be a powerful financial boost for your business. Whether you’re expanding, managing cash flow, or upgrading technology, quick access to funds can make a significant difference. With options like the Udyam Flex Loan from Vivifi India Finance Pvt. Ltd., you can get the support you need to propel your business forward. Consider this loan as your “Business ka Booster”, helping you to unlock new opportunities and achieve long-term success.